Introduction

This document presents the results of all NHS trusts and NHS foundation trusts (termed ‘providers’) in England. The Department of Health and Social Care (DHSC) uses the provider sub-consolidation as part of the DHSC group accounts. We are very grateful to NHS providers for their co-operation in reporting their data to us.

These accounts are presented separately from those of NHS England as NHS England is not the parent body of NHS trusts and NHS foundation trusts.

The introduction describes the legal requirements for NHS trust and NHS foundation trust accounts and organisational changes in the provider sector in 2021/22 and 2022/23.

NHS trusts

Paragraph 11A(3) of Schedule 4 of the National Health Service Act 2006 (the 2006 Act) (as inserted by Section 87 of the Health and Care Act 2022) requires each NHS trust to prepare annual accounts for each financial year ending 31 March. These annual accounts must be audited by auditors appointed by the NHS trust.

NHS trusts that cease to exist as separate legal entities during the year (including on authorisation as an NHS foundation trust) prepare accounts for their final period as directed by the Secretary of State and have them audited.

NHS foundation trusts

Paragraph 25 of Schedule 7 to the 2006 Act (as amended by paragraph 31(3) of Schedule 5 to the Health and Care Act 2022) requires each NHS foundation trust to prepare annual accounts for the period beginning on the date it is authorised and ending the following 31 March and for each successive 12-month period. These annual accounts must be audited by auditors appointed by the NHS foundation trust’s council of governors. The trust must lay a copy of the accounts, and any auditor’s report on them, before Parliament and send them to NHS England.

NHS foundation trusts that cease to exist as separate legal entities before the end of the year continue to prepare accounts for their final period as directed by NHS England and have them audited, but do not present them to the council of governors.

Basis of preparation for consolidated NHS provider accounts

Section 65Z4 of the National Health Service Act 2006 (as inserted by Section 14 of the Health and Care Act 2022) requires NHS England to prepare, for each financial year, a set of accounts that consolidates the annual accounts of all NHS trusts and NHS foundation trusts. The Secretary of State has given directions on the content and form of these consolidated accounts and the principles to be applied in preparing them. The Comptroller and Auditor General is required to examine, certify and report on the consolidated NHS provider accounts and send a copy of his report to the Secretary of State and NHS England. NHS England is required to lay the consolidated provider accounts and the Comptroller and Auditor General’s report before Parliament.

Organisation terminology

NHS Improvement, as the operating name for the NHS Trust Development Authority and Monitor legal entities, was the organisation responsible for the oversight of NHS providers during the first quarter of 2022/23. From 2019, NHS Improvement operated jointly with NHS England. On 1 July 2022 the NHS Trust Development Authority and Monitor were abolished and their functions transferred to NHS England. These consolidated accounts reference other documents issued by NHS England: in some cases these will have been issued by predecessor legal bodies. Documents issued by the NHS Trust Development Authority and Monitor before they were abolished are treated, from 1 July 2022, as having been issued by NHS England.

Changes in legal status of NHS providers

These consolidated NHS provider accounts incorporate the results of all NHS trusts and NHS foundation trusts. Entities for which legal status changed in 2021/22 or 2022/23 are as follows:

| NHS trusts | NHS foundation trusts | All providers | ||

|---|---|---|---|---|

| 1 April 2021 | Number of providers at start of year Includes dissolution of Brighton and Sussex University Hospitals NHS Trust on acquisition by University Hospitals Sussex NHS Foundation Trust | 70 | 145 | 215 |

| 1 June 2021 | Dissolution of North West Boroughs Healthcare NHS Foundation Trust on acquisition by Mersey Care NHS Foundation Trust. |

| -1 | 214 |

| 1 October 2021 | Dissolution of The Pennine Acute Hospitals NHS Trust on acquisition by Salford Royal NHS Foundation Trust; entity renamed as Northern Care Alliance NHS Foundation Trust. | -1 |

| 213 |

| 31 March 2022 | Number of providers at end of year | 69 | 144 | 213 |

| 1 April 2022 | Dissolution of Northern Devon Healthcare NHS Trust on acquisition by Royal Devon and Exeter NHS Foundation Trust; entity renamed as Royal Devon University Healthcare NHS Foundation Trust. | -1 |

| 212 |

| 31 March 2023

| Number of providers at end of year | 68 | 144 | 212 |

Review of financial performance of NHS providers

| 2022/23 | 2021/22 | |

|---|---|---|

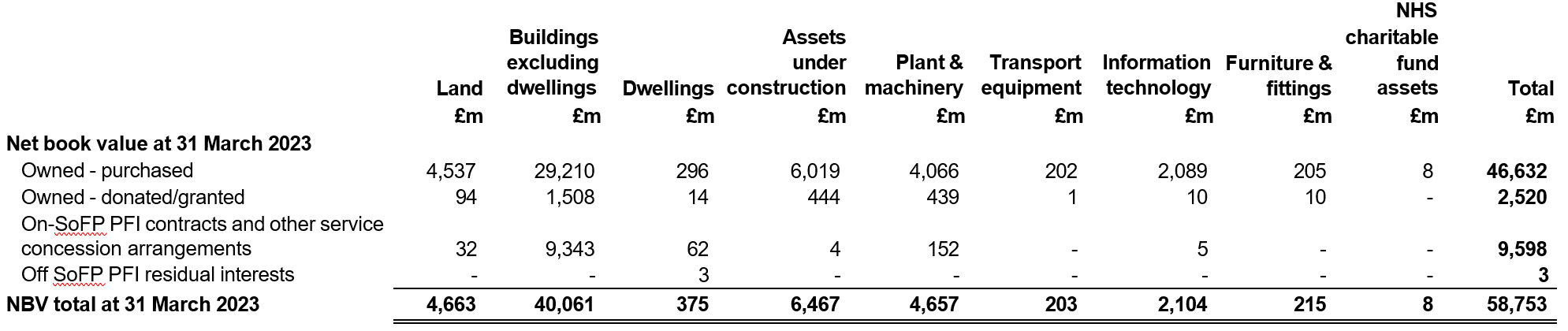

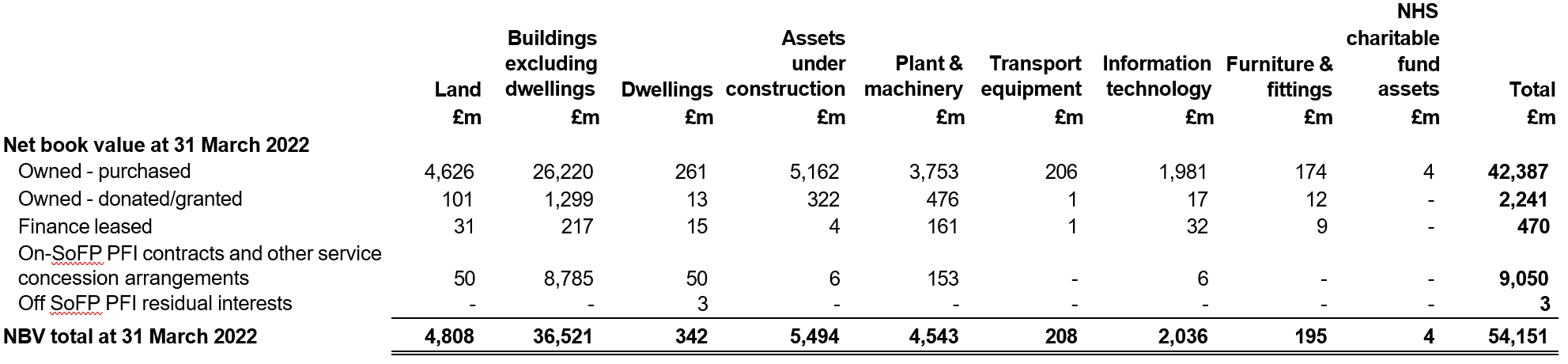

| Number of NHS providers in existence during the year |

212 |

215 |

| Surplus/(deficit) before impairments and transfers | (£457 million) | £562 million |

| Number of NHS providers recording a deficit before impairments, transfers and consolidation of charitable funds | 105 | 74 |

| Capital expenditure (purchases and new or modified leases of property, plant and equipment and intangible assets – accruals basis) See ‘capital expenditure’ section below for information on impact of new leasing accounting standard in 2022/23. | £7,803 million | £6,917 million |

The NHS made substantial progress on many of its strategic priorities for 2022/23, including delivering record numbers of urgent cancer diagnostic tests and significantly reducing long waits for elective care, nearly eliminating two year waits by July 2022, but there was substantial pressure on emergency performance. The progress against priorities was delivered against an ongoing environment of high levels of COVID infection, industrial action impacting on productivity and increased costs due to inflation.

The Health and Care Act 2022 established 42 integrated care boards on 1 July 2022, replacing 106 clinical commissioning groups. Further information on the role of integrated card boards can be found on the NHS England website.

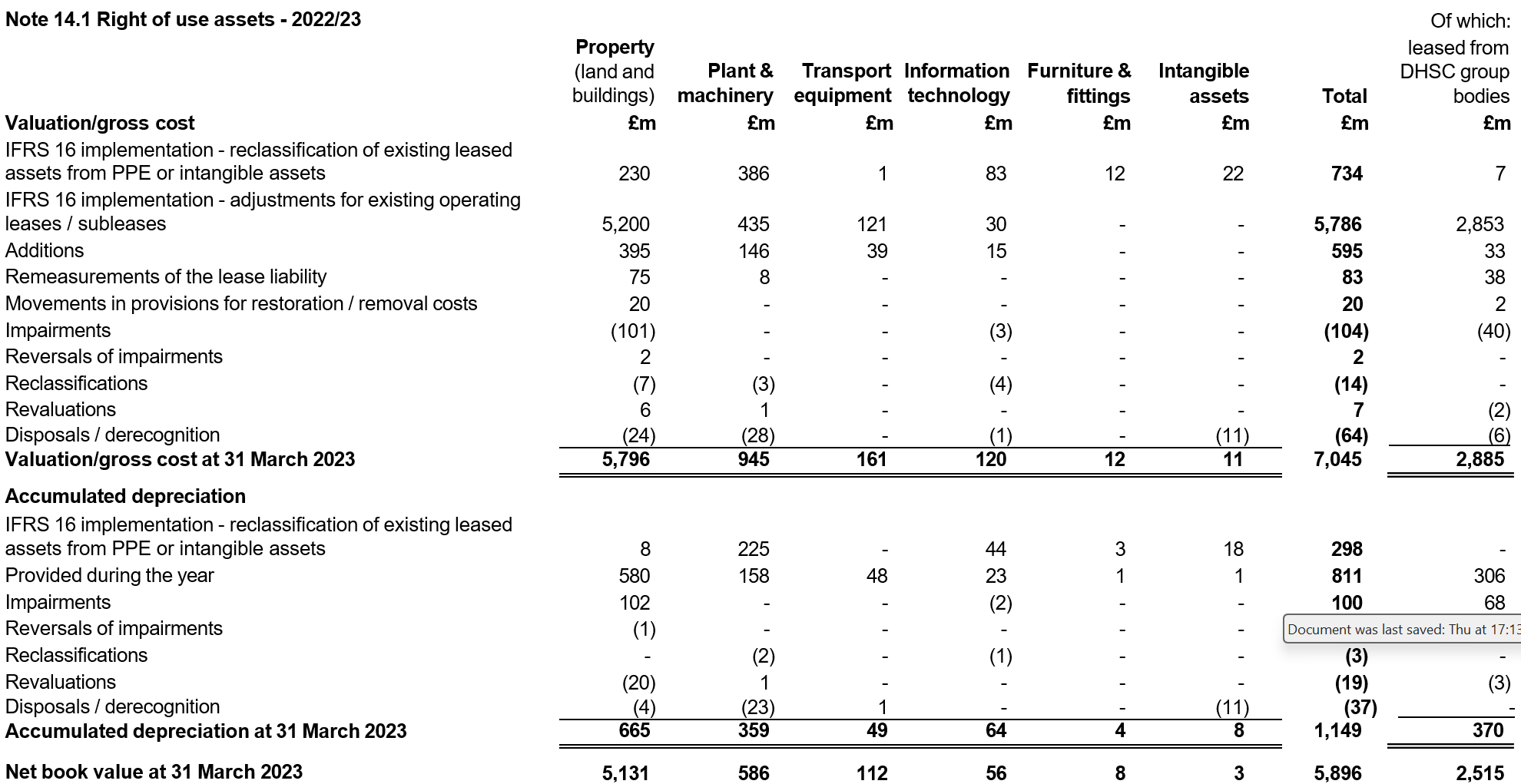

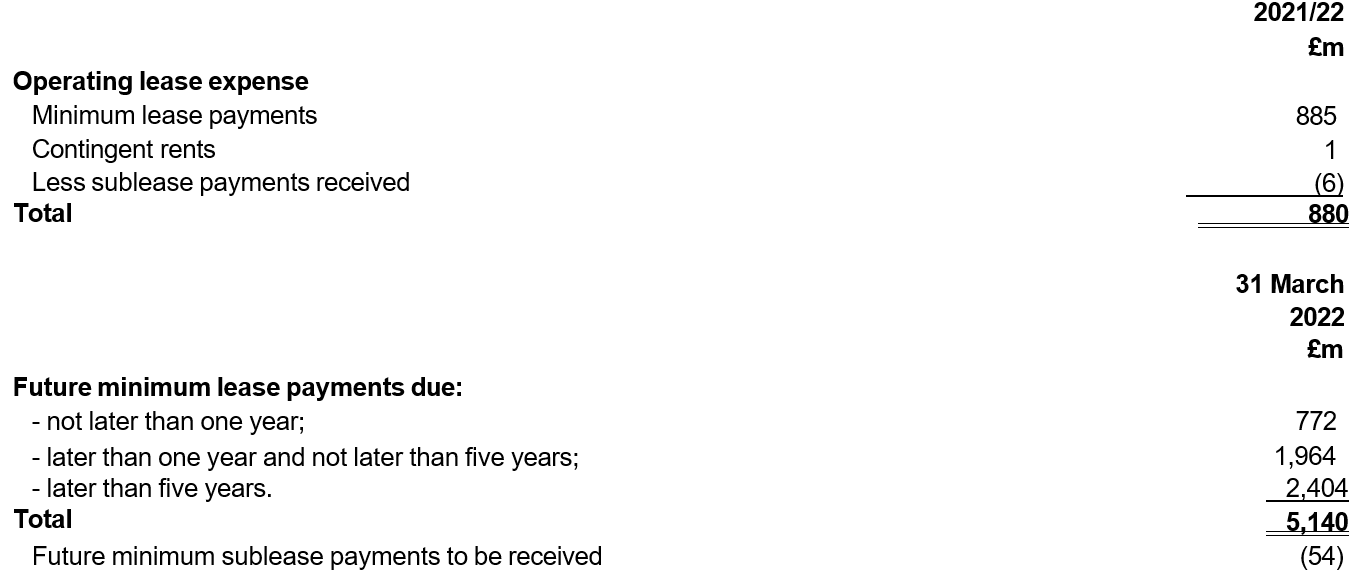

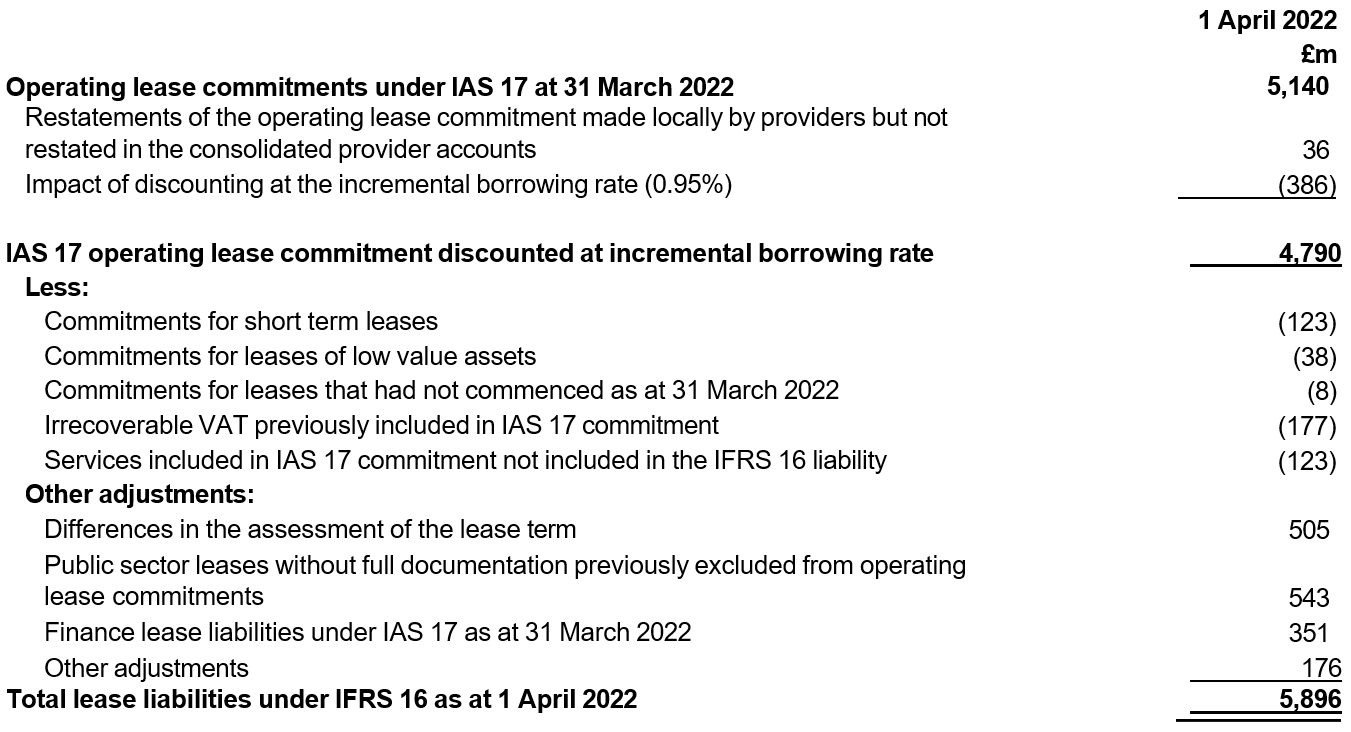

The implementation in the NHS of a major new accounting standard for leasing means there are significant changes to financial reporting this year. IFRS 16 Leases brings on balance sheet the majority of leased assets, materially increasing non-current assets and borrowings across NHS providers. Lease payments previously charged to expenditure as incurred have been replaced with depreciation and interest charges.

More information on the implementation of IFRS 16 is given in accounting policy 1.10 and note 14.6 to the financial statements.

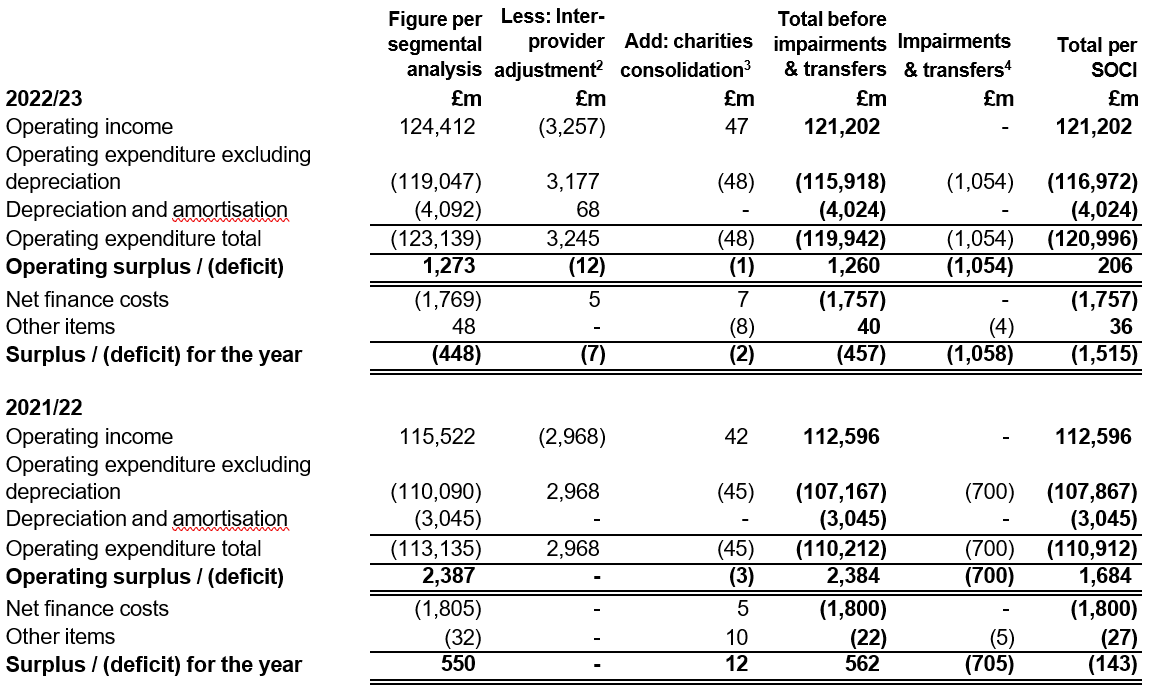

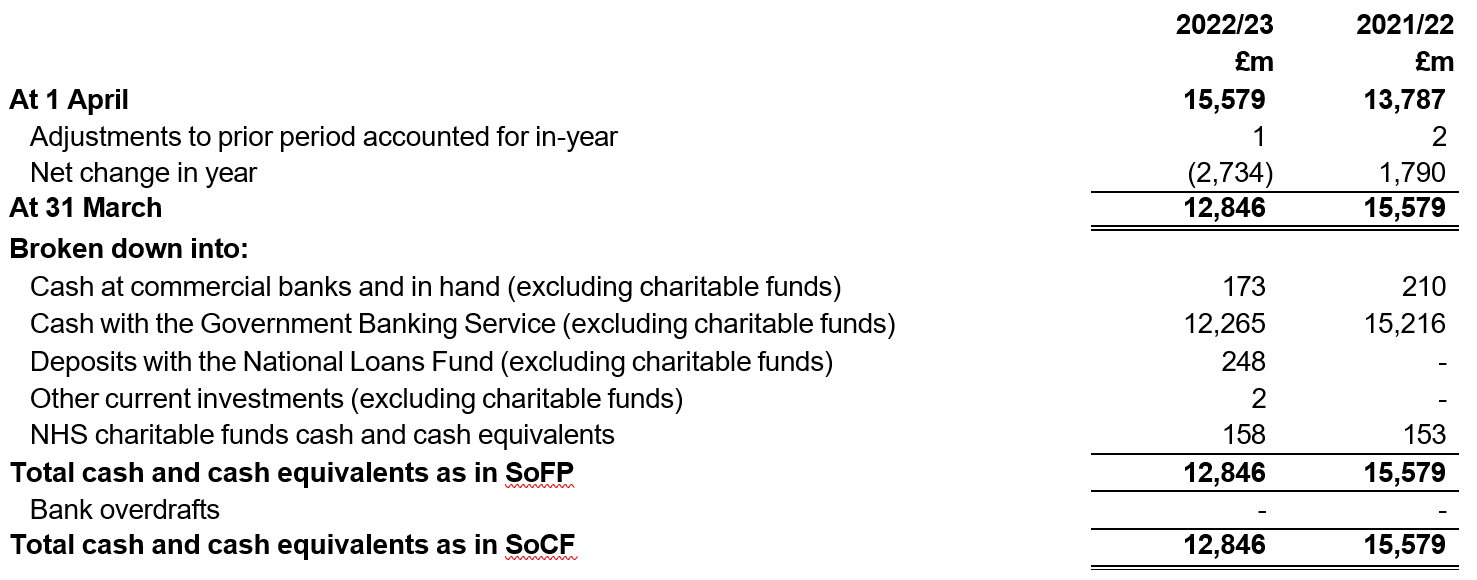

The provider sector delivered a net deficit before impairments and gains and losses on transfers by absorption for the year ended 31 March 2023 of £457 million (2021/22 £562 million net surplus) and held cash of £12.8 billion as at 31 March 2023 (31 March 2022:

£15.6 billion). NHS providers are not required to break even in every year. Providers are required to exercise their functions in line with the relevant plans of the integrated care board to achieve balance across the integrated care system as a whole, allowing for local allocation and prioritisation of available resources.

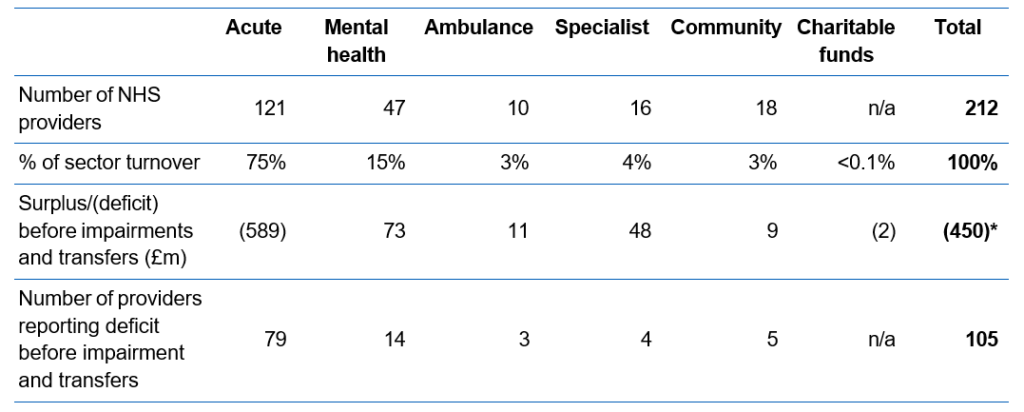

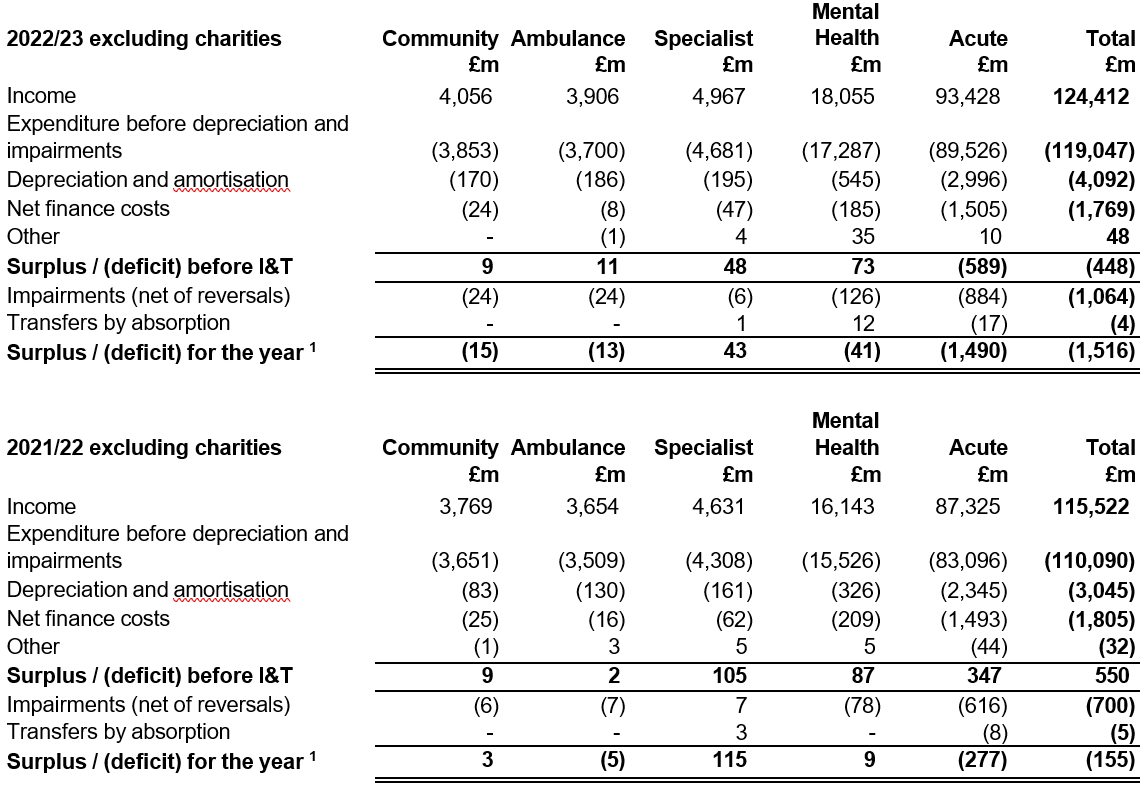

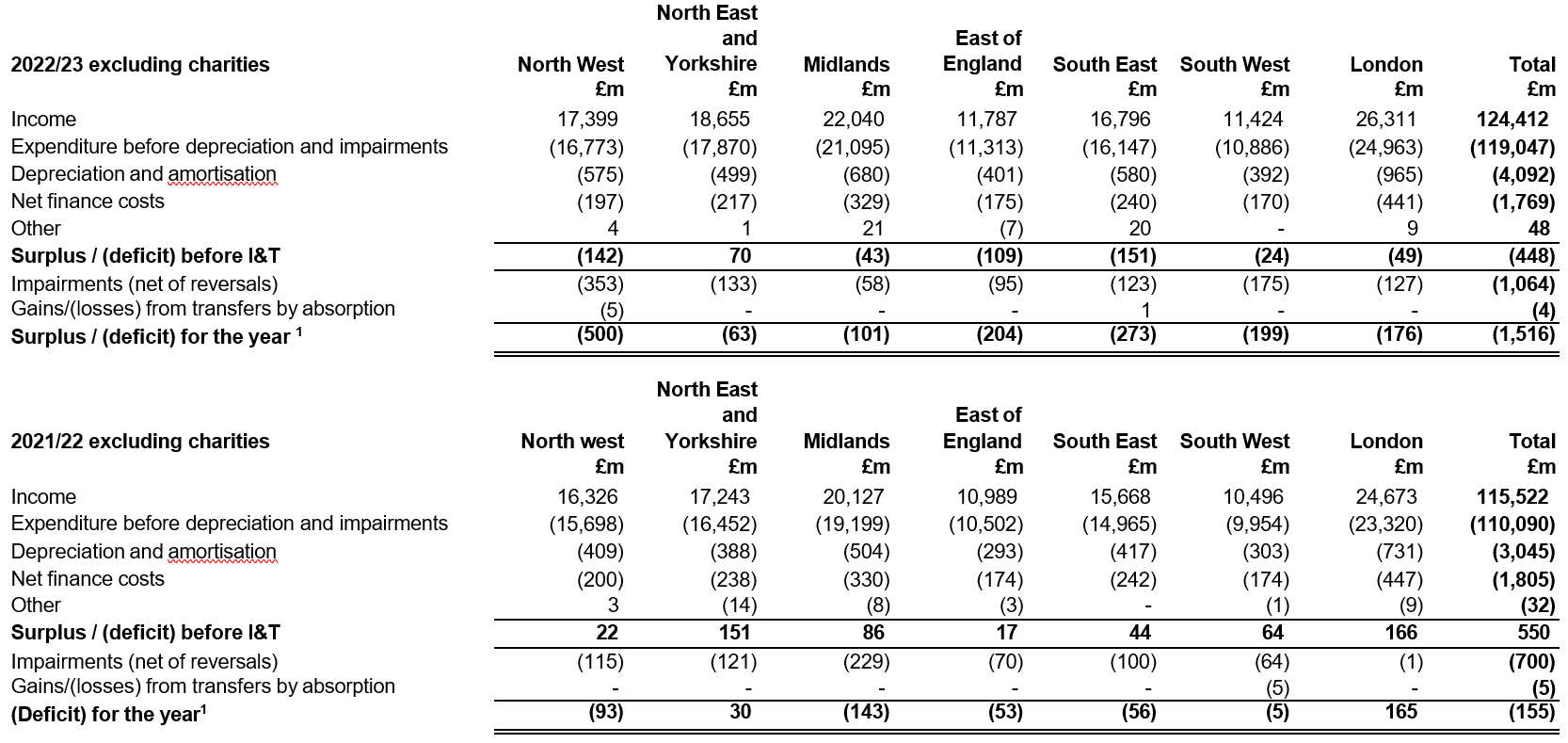

The following table shows the profile of NHS providers that made up the sector during 2022/23. Providers are classified by their principal services but they may also provide other services.

* Following the initial application of IFRS 16 Leases, lessee and lessor accounting treatments are no longer aligned. The aggregate of the surplus/(deficit) from individual provider accounts does not equal the consolidated deficit in these accounts due to the impact of eliminating lease arrangements between NHS providers.

The results for the year showed that, excluding the consolidation of charitable funds, 107 NHS providers (50%) (2021/22: 141 (66%)) delivered a surplus or broke even and 105 providers (50%) (2021/22: 74 (34%)) reported a deficit before impairments and transfers by absorption. The gross deficit of all providers in deficit increased from £141 million in 2021/22 to £1,009 million in 2022/23. Of the 141 trusts that reported a surplus in 2021/22, 57 (40%) reported a deficit in 2022/23, while 23 (31%) of the trusts reporting a deficit in 2021/22 reported a surplus in 2022/23.

Figure 1 shows the distribution of providers’ surplus or deficit for 2022/23 and 2021/22. The two lines are plotted independently.

Where NHS charitable funds are locally deemed to be controlled by an NHS provider, the financial results of the charities are consolidated in these accounts. 44 NHS providers consolidated charitable funds, contributing an aggregate deficit of £2 million (2021/22: 43 providers consolidated a £12 million surplus) and net assets of £348 million (31 March 2022: £352 million).

The NHS Oversight Framework sets out the principles for system accountability and improvement support where appropriate. Providers who are in segment 4 of the oversight framework are entered into the Recovery Support Programme (RSP). This programme provides focused and integrated support to systems as well as individual organisations. As at 31 March 2023, 13 providers reporting a deficit were also receiving support in the RSP (31 March 2022: 7 providers). This support may not be finance related in all cases.

208 of 212 NHS provider financial statements received unqualified true and fair audit opinions at the time of finalising these accounts on 15 January 2024 (2021/22: 195). The results of two providers have been consolidated based on unaudited accounts information provided by the Trust. Further information on these two providers is provided in note 31 to these consolidated financial statements. The impact of current constraints in the local audit environment is discussed in the annual governance statement. University Hospitals of Leicester NHS Trust received a modified audit opinion qualified in two respects: evidence for plant and equipment asset existence, and the impact of additional qualifications in previous years’ financial statements affecting comparative figures. More information is provided in note 32 to the financial statements.

One provider (2021/22: 19) received an opinion qualified for a limitation of scope in respect of inventories where sufficient assurance could not be obtained over material inventory balances at a previous year end. This arose because restrictions on movement in response to the COVID-19 pandemic prevented some providers from performing year-end inventory counts and/or auditors from attending such counts in previous years. The impact is not material to these consolidated accounts.

All providers have prepared financial statements on a going concern basis. HM Treasury’s Financial Reporting Manual (FReM) defines that a public sector body will be a going concern where continuation of the provision of services is anticipated in the future. The same definition is applied by NHS providers in preparing their financial statements. The accounting policies contain our going concern assessment for these consolidated accounts.

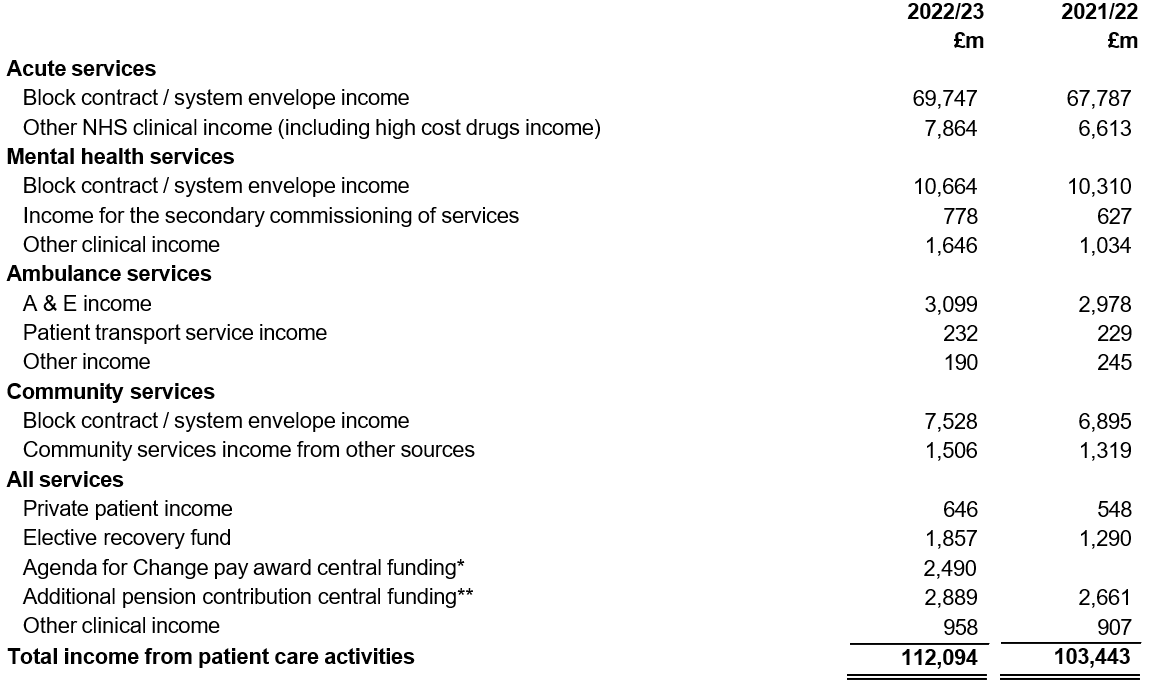

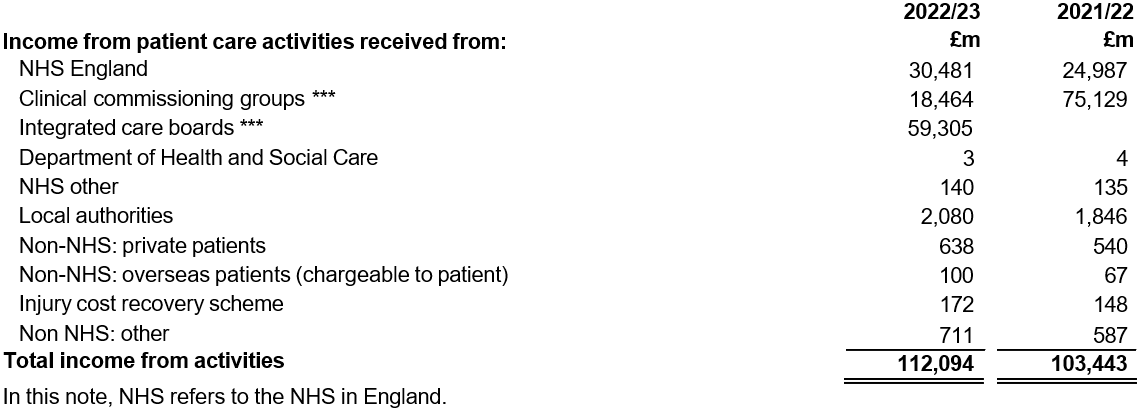

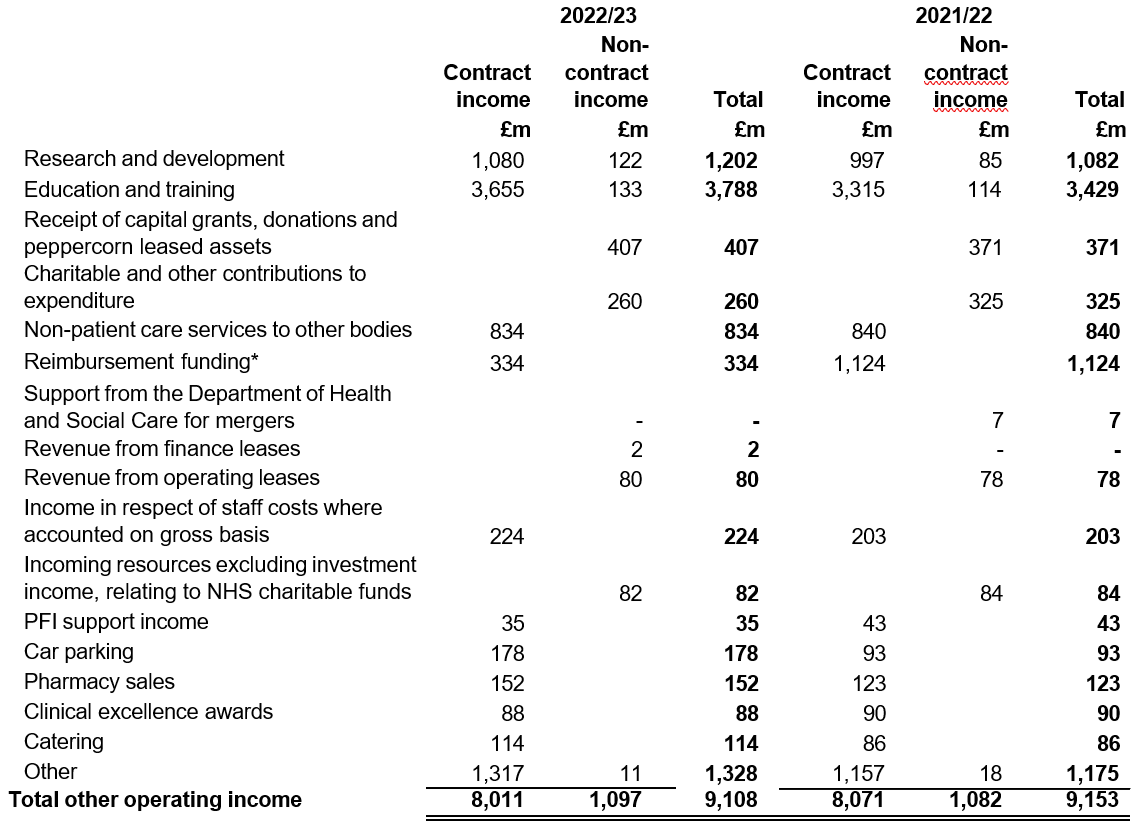

Operating income

In the year to 31 March 2023, 212 NHS providers generated total operating revenues of

£121.2 billion, an increase of £8.6 billion (7.6%); a real terms increase of 0.9% when adjusted for inflation. The increase includes additional funding for ‘agenda for change’ pay uplifts in 2022/23.

NHS-led provider collaboratives became more established during 2022/23, providing a new model of commissioning of mental health, learning disability and autism services to bring specialist care into a community setting. Increased income is recognised by lead providers who are commissioning services from other healthcare bodies.

Operating expenditure

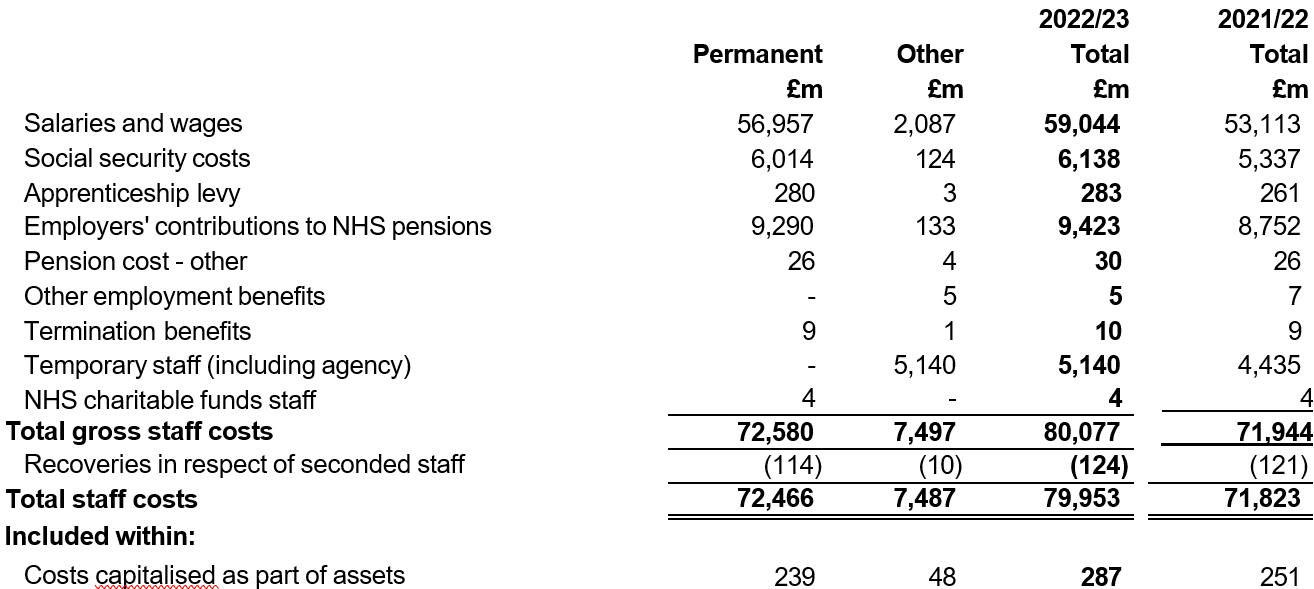

Total operating expenditure increased by 9.1% from £110.9 billion in 2021/22 to £121.0 billion in 2022/23; a real terms increase of 2.3% when adjusted for inflation.

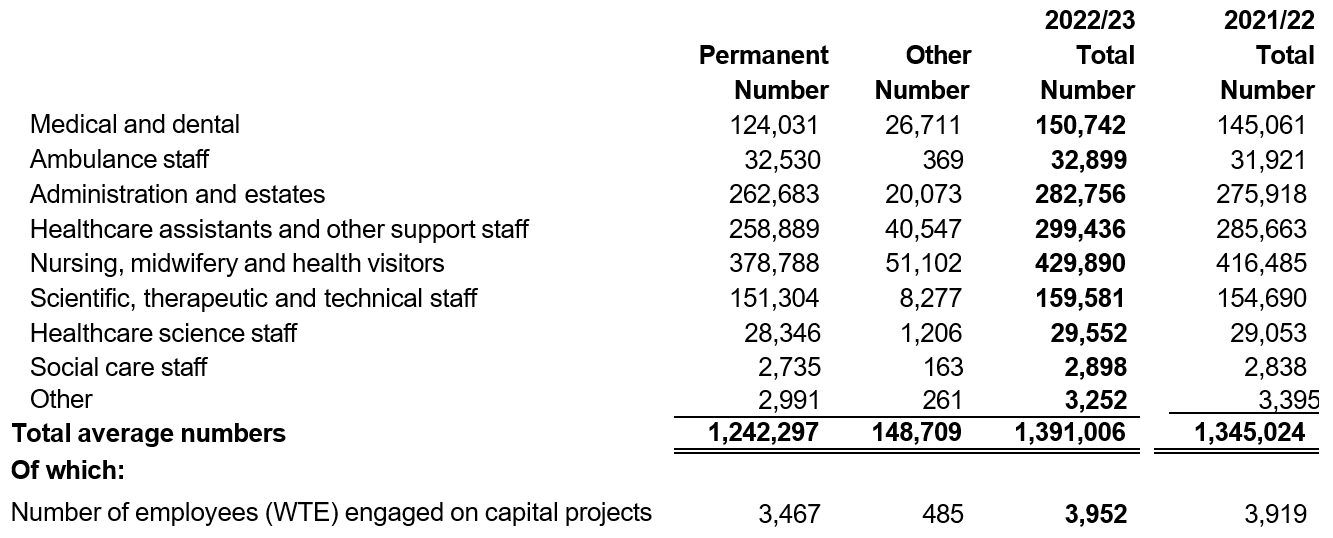

79% (£8.0 billion) of the increase in operating expenditure related to employee costs, which is largely driven by the pay awards for 2022/23. A focus on reducing waiting lists and the impact of industrial action has required increased use of temporary staff further driving up employee costs. Tackling backlogs has also increased supplies, services and drugs costs. This includes higher spend on cancer drugs alongside higher treatment volumes with significant reductions in the number of patients waiting more than 62 days for cancer diagnosis or treatment.

Other premises costs in the chart above have previously included expenditure on operating leases. The implementation of IFRS 16 Leases in 2022/23 brought the majority of lease arrangements on balance sheet with a reduction in lease payments charged to operating expenditure and an increase in depreciation recognised.

The roll-out of provider led collaboratives for the secondary commissioning of certain specialist mental health and learning disability services as well as initiatives for the reduction of elective waiting lists have led to an increase in healthcare services purchased by NHS providers from non-NHS bodies which forms part of the other movements in operating expenditure.

Impact of impairments

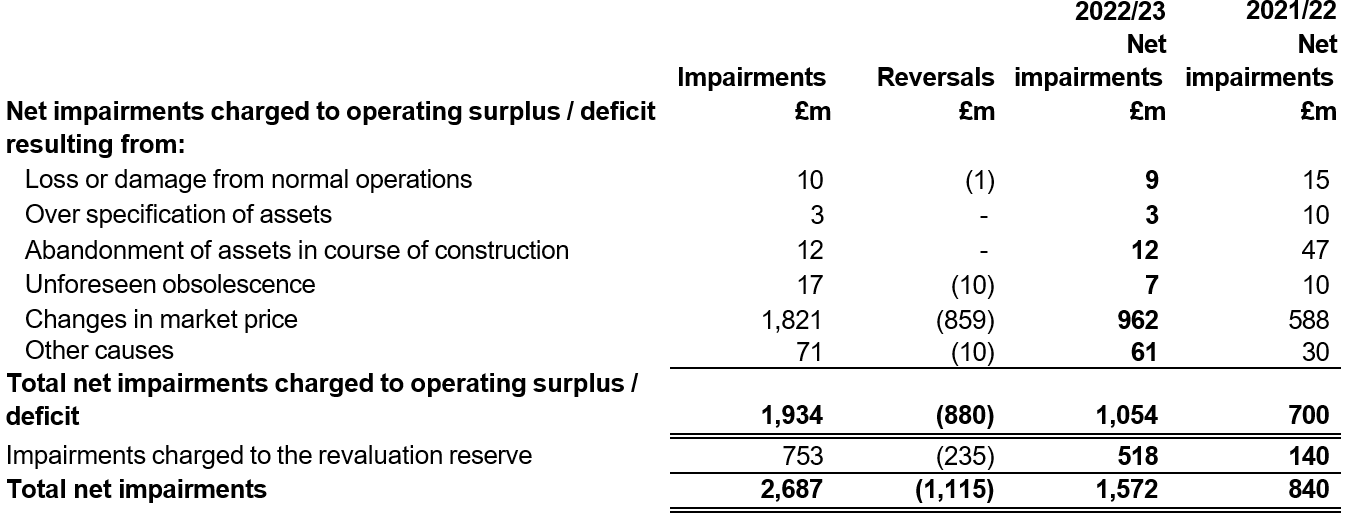

Impairments to the carrying value of assets are charged to operating surplus except where previous revaluation surpluses remain: in such cases a reduction is first recognised in the revaluation reserve to the extent of the remaining surplus for that asset. Where the impairments are the result of a permanent loss, such as fire damage, they are always charged to expenditure. In 2022/23 net impairments charged to income and expenditure were £1,054 million (2021/22: £700 million). A further £518 million of net impairments was charged to reserves (2021/22: £140 million), reducing previously recognised revaluation surpluses. Providers also recognised revaluation surpluses directly in reserves totalling £2,431 million (2021/22: £1,534 million). This results in a net upwards valuation movement on non-current assets of £859 million compared to only £694 million in 2021/22.

There were 135 NHS providers recording a net impairment within surplus/deficit in 2022/23 (2021/22: 133) while 64 providers recorded net reversals of impairments (2021/22: 63). This increase in net impairments includes £192 million of impairments to right of use assets newly recognised on balance sheet following the implementation of IFRS 16 Leases.

Of the £1,054 million of net impairments charged to income and expenditure, 91% arose from changes in market price, compared to 84% in 2021/22. These impairments reflect market conditions at the time of valuation and not a deterioration in the service potential of the asset. Further details of impairments are provided in note 9 to the accounts.

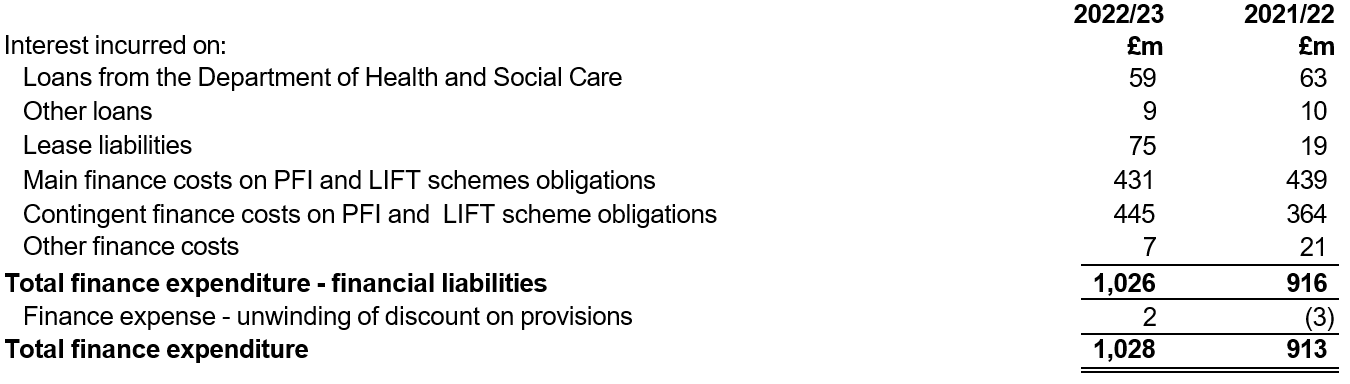

Net finance costs

Net finance costs in 2022/23 showed a net decrease of £43 million to £1,757 million. The significant increase in the Bank of England base rate during 2022/23 enabled providers to generate interest income on cash balances which outweighed the increase in contingent rent on private finance initiative and similar schemes as well as interest charges arising on lease liabilities recognised following the implementation of IFRS 16 Leases.

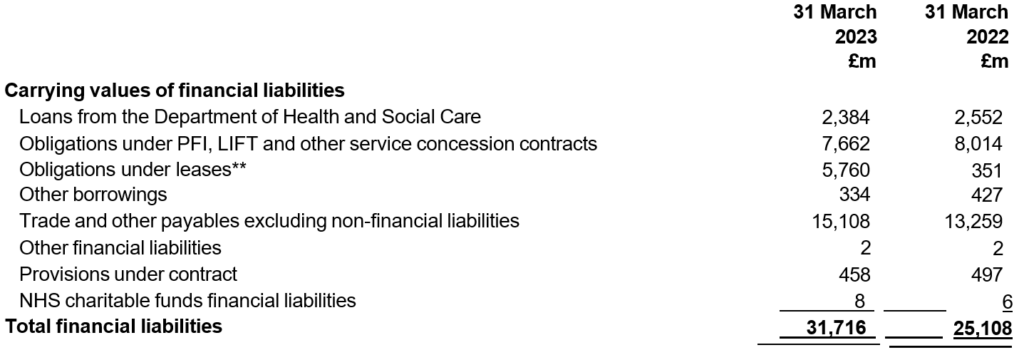

Working capital and borrowings

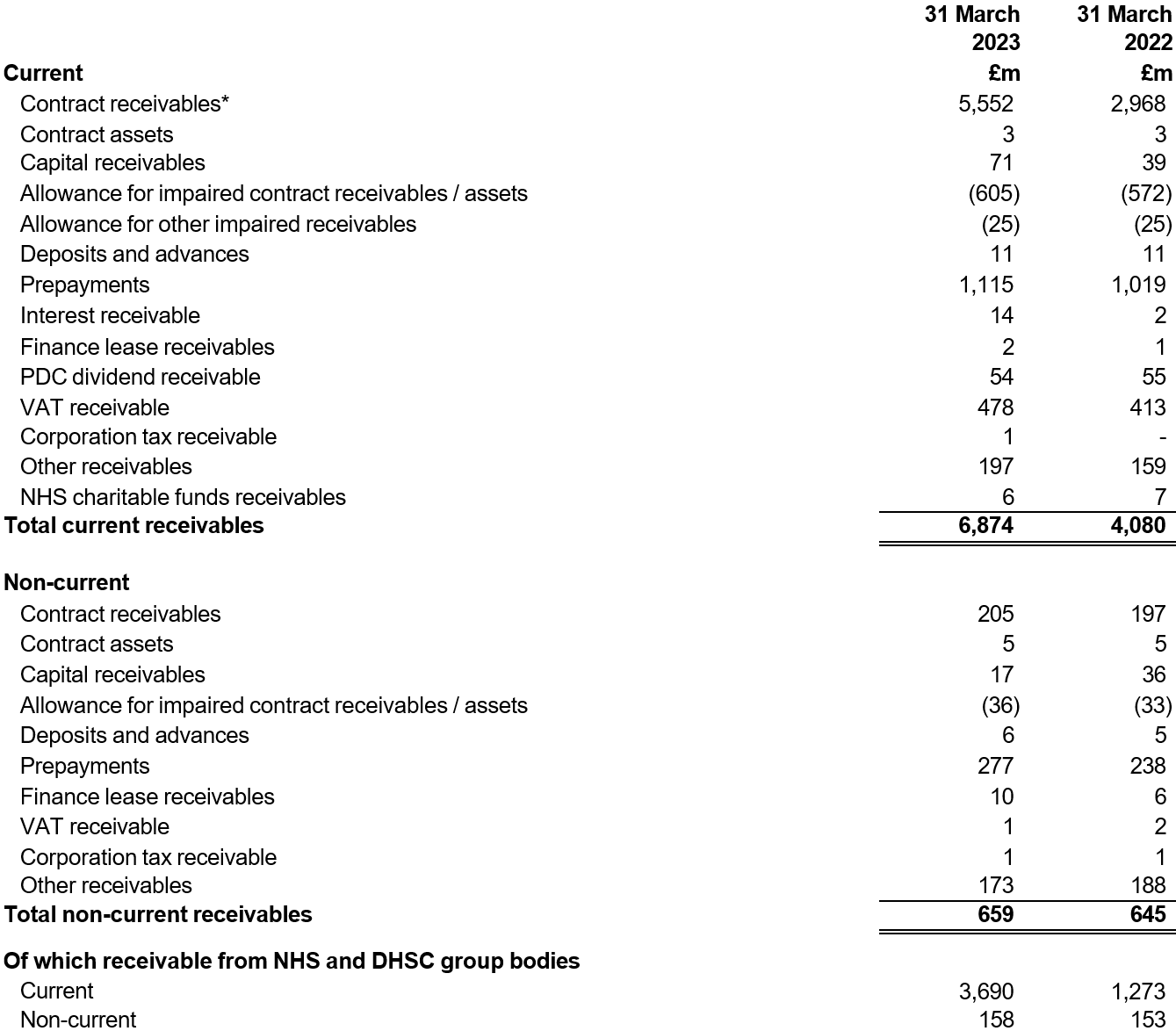

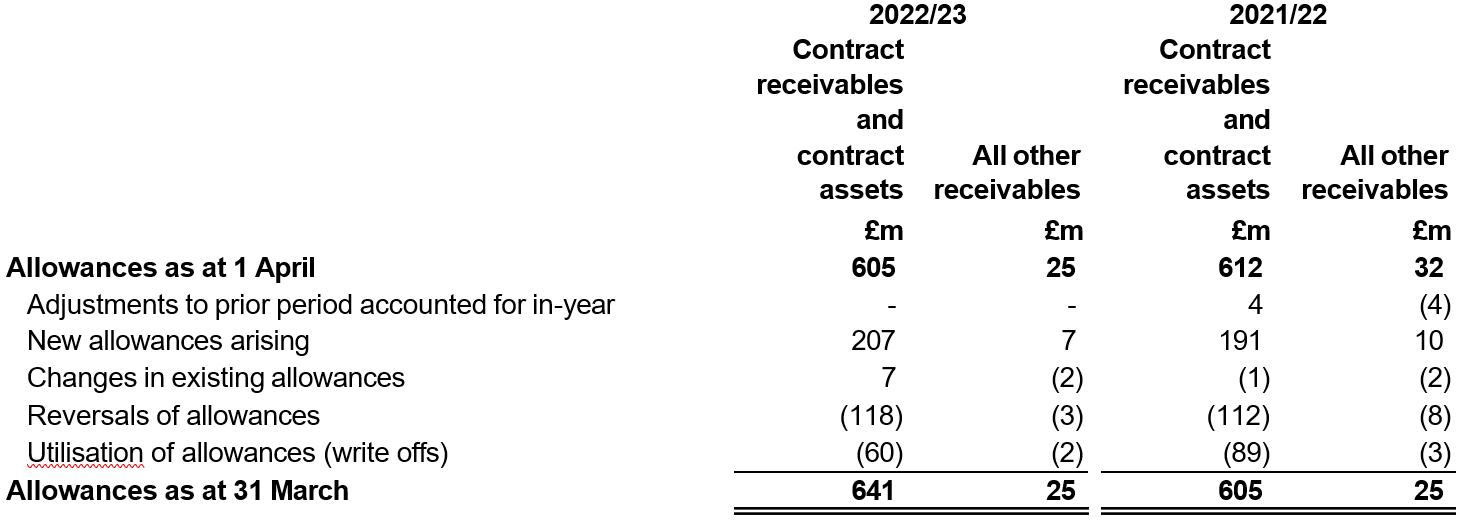

At 31 March 2023, NHS providers held cash and cash equivalents of £12.8 billion; equivalent to 6.1 weeks’ operating costs in a sector with annual revenue of £110.5 billion (31 March 2022: 7.8 weeks). This revenue figure excludes the 6.3% NHS pension contribution made by NHS England and the 2022/23 non-consolidated pay award.

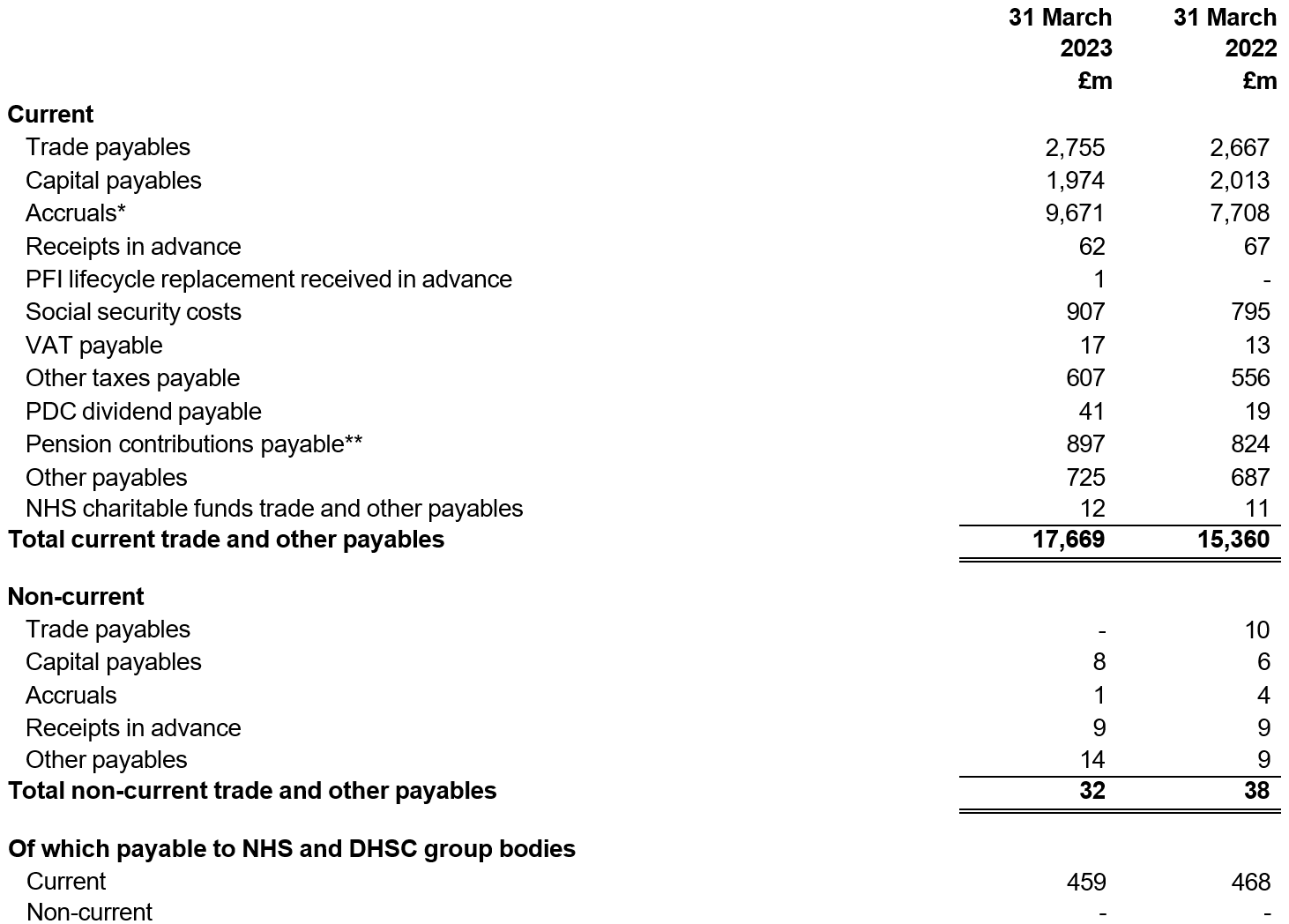

The number of receivables days is broadly stable between year ends at 13.3 days in 2022/23 (2021/22: 13.0 days). Payable days decreased to 40.6 days in 2022/23 from

42.5 days in 2021/22. Providers are monitored on their reported timeliness in paying suppliers. Both calculations exclude the impact of the 2022/23 non-consolidated pay award accrued at the year end.

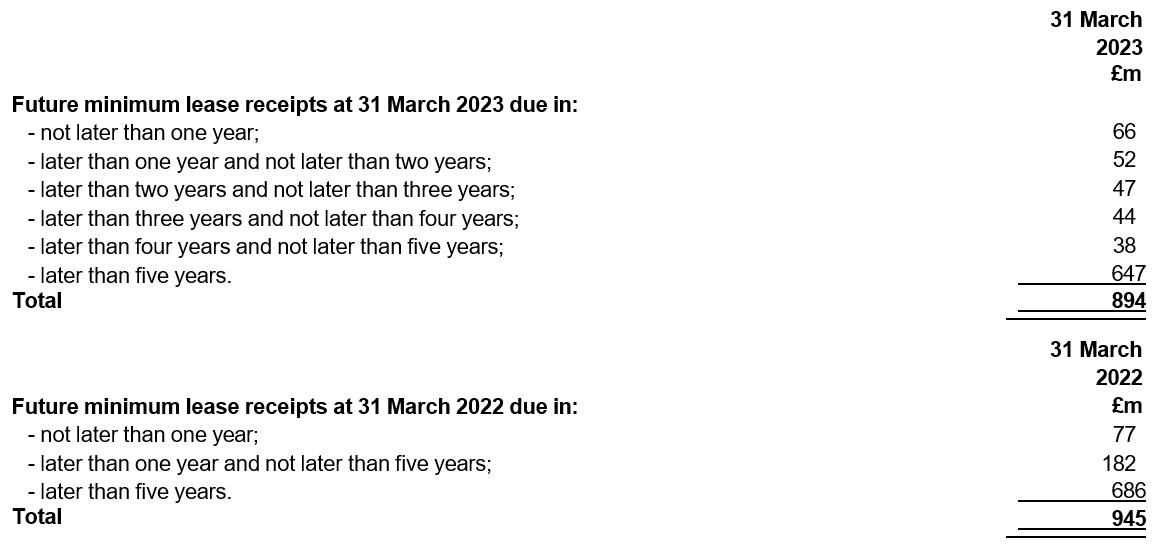

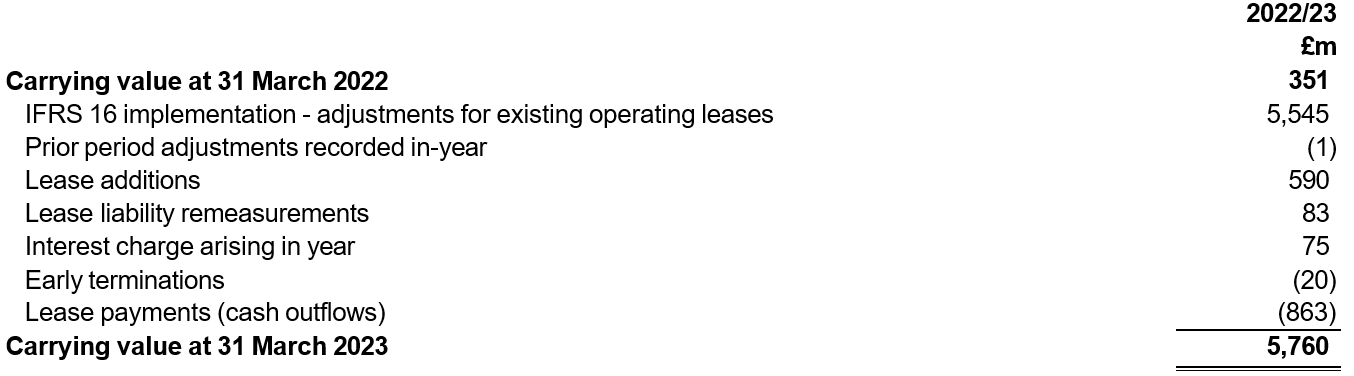

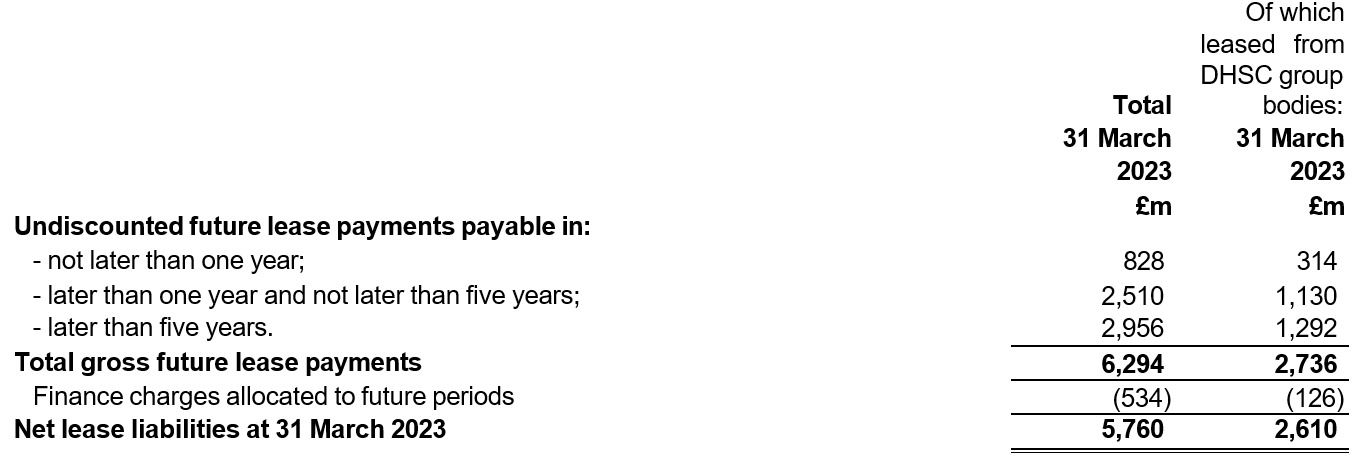

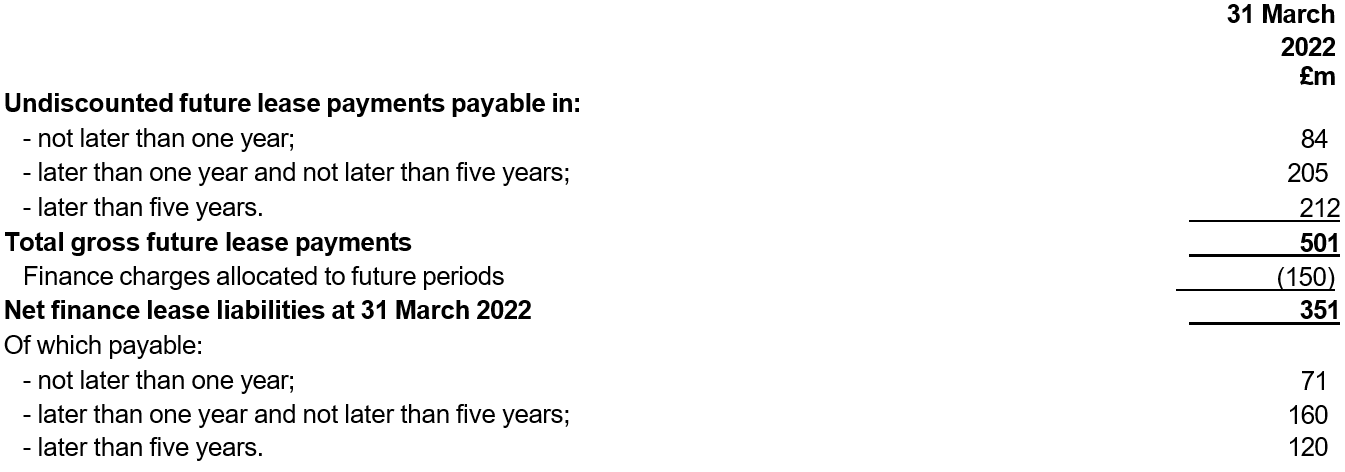

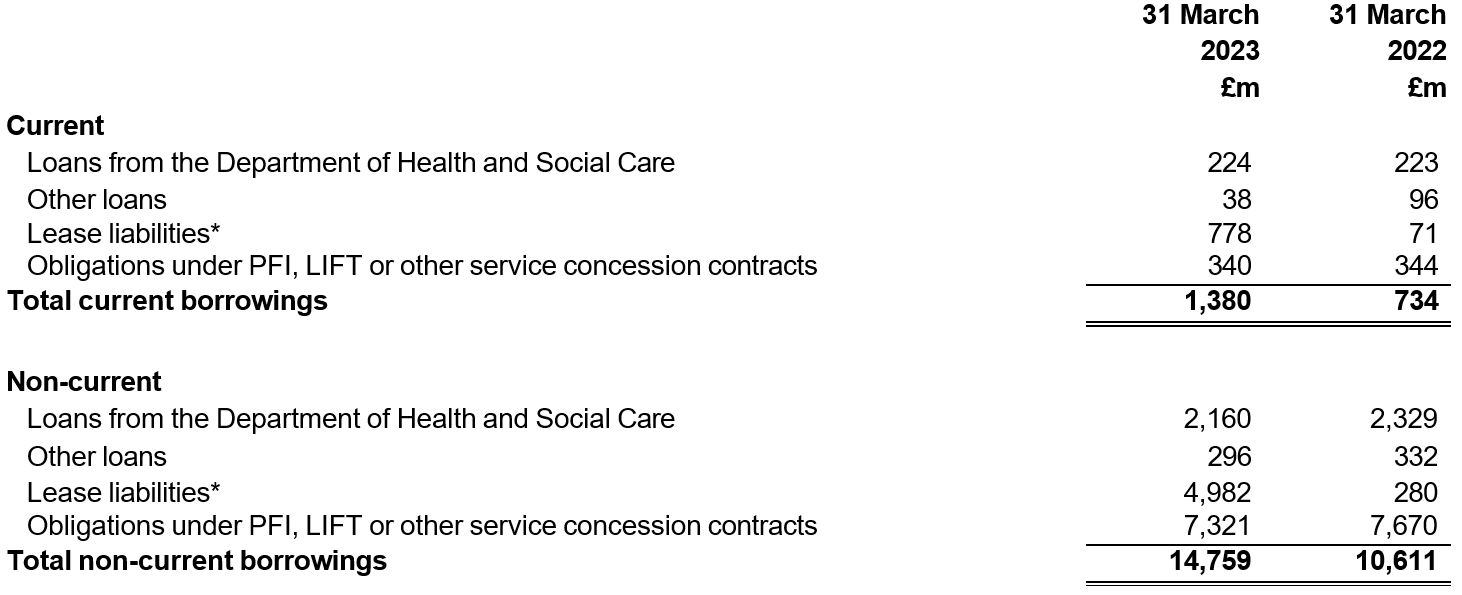

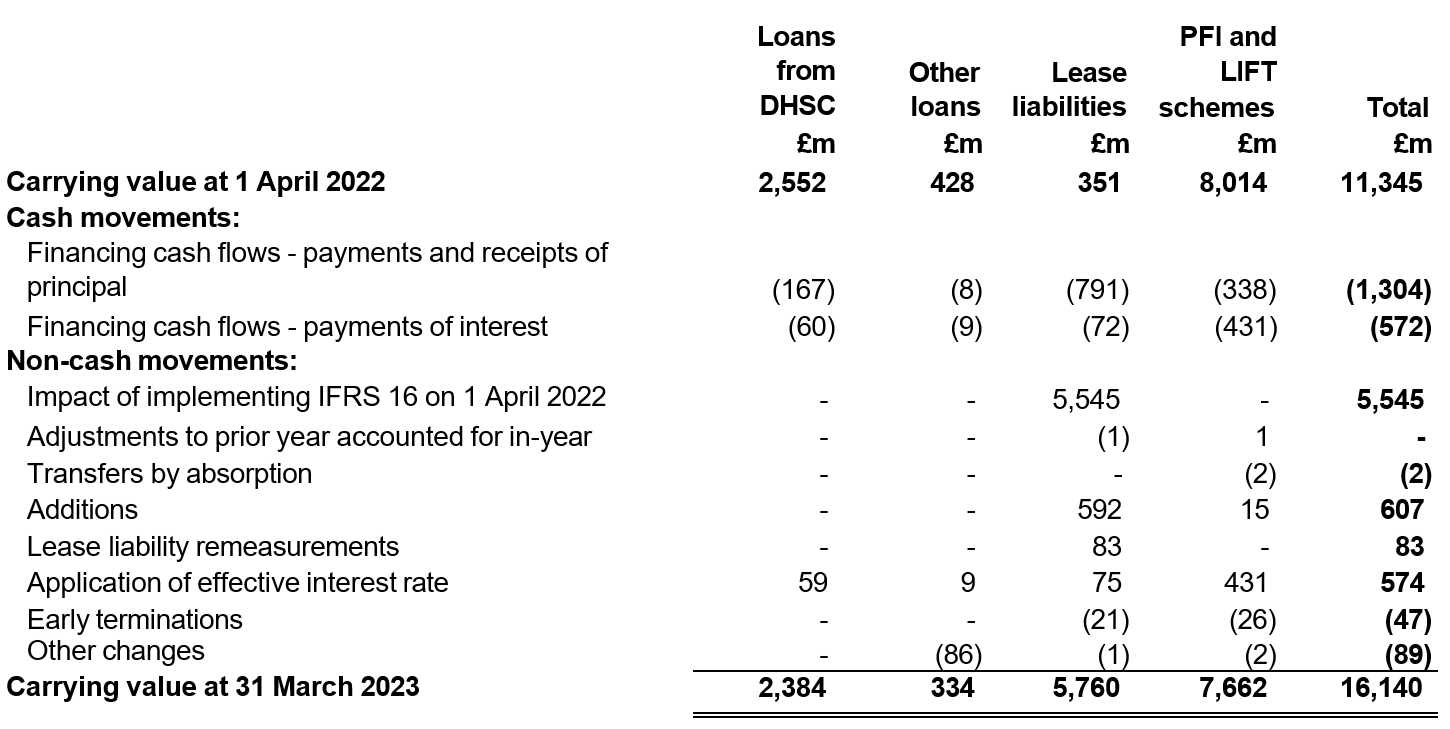

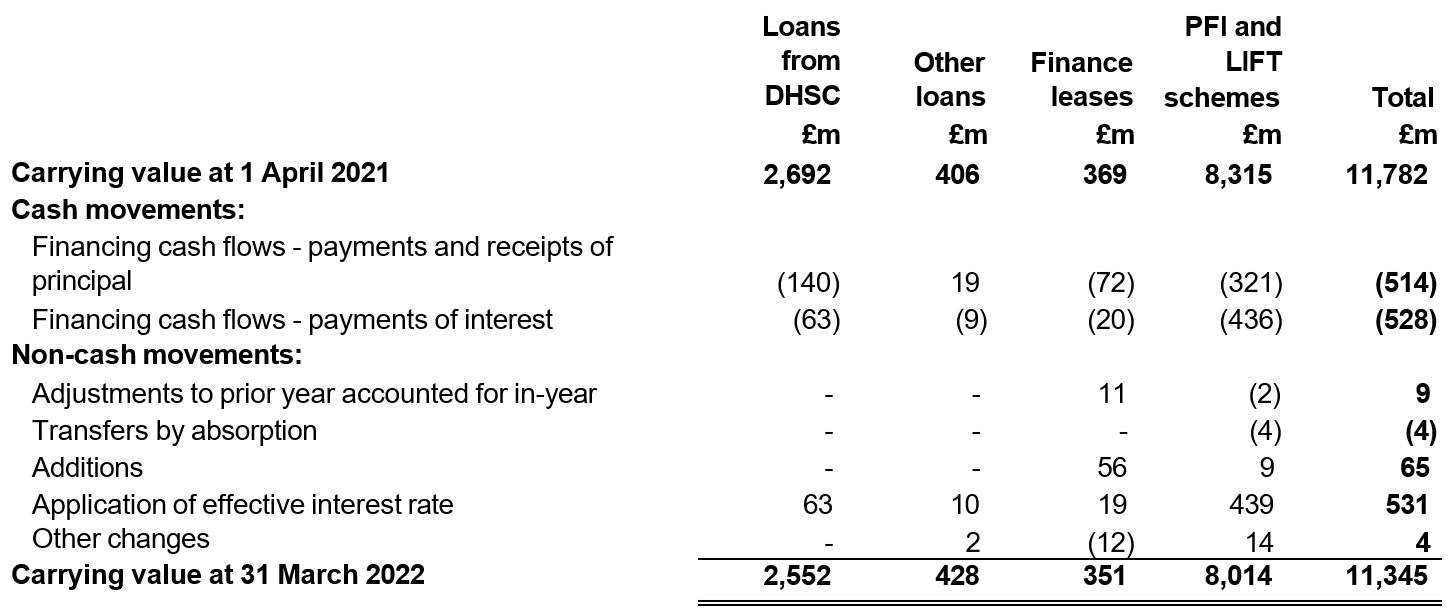

Total long-term and working capital borrowing at 31 March 2023 was £16.1 billion (31 March 2022: £11.3 billion). This increase in borrowings is mainly a result of implementing IFRS 16 Leases. As at 31 March 2023 the provider sector recognised

lease liabilities of £5,760 million (31 March 2022: £351 million). More information is provided about lease liabilities recognised upon implementation of the new standard on 1 April 2022 in note 14.6 to the financial statements.

Capital expenditure

Providers’ ability to invest in capital schemes is limited by constraints in DHSC’s capital expenditure limit. This capital expenditure limit was increased to reflect the implementation of IFRS 16 Leases, where new leases commencing in 2022/23 are capitalised rather than recognised in expenditure. In 2022/23 the provider sector incurred an additional £619 million of gross capital expenditure (after the elimination of inter-provider leases) as a consequence of applying the new standard.

Integrated care systems are allocated capital budgets termed capital envelopes to cover day-to-day operational capital investment which allows for local prioritisation of available resources within the system. These allocations are supplemented with centrally allocated funds to cover nationally strategic projects such as new hospitals and hospital upgrades. Further resource was also available in 2022/23 to cover national programmes such as elective recovery, diagnostics and the programme to eradicate dormitories from mental health facilities.

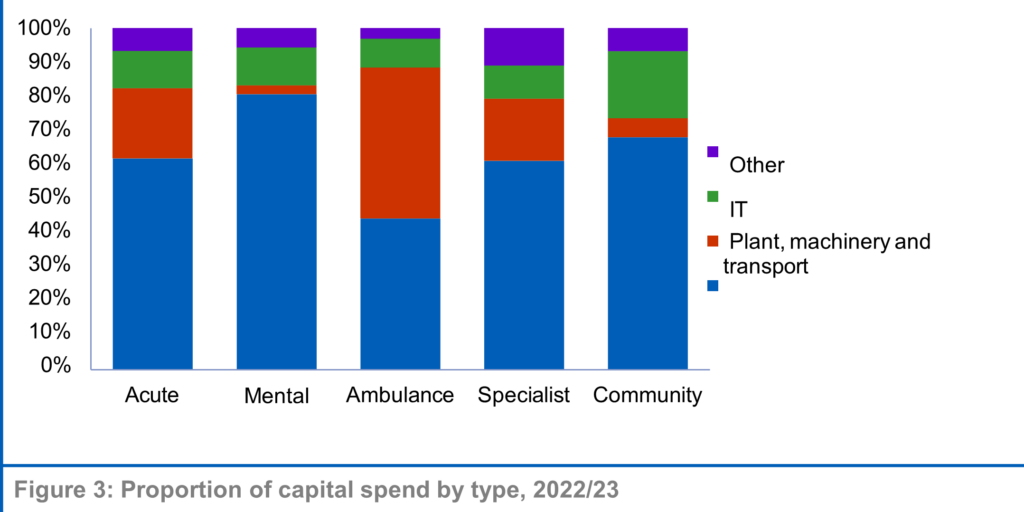

Total purchases and new or modified leases of property, plant and equipment and intangible assets were £7.8 billion (2) (2021/22: £6.9 billion). More than half (63%) of capital spend was on land and buildings, with a further 19% on plant, equipment and transport, 11% on information technology, and 7% on other capital (Figure 3).

Figure 3: proportion of capital spend by type, 2022/23

(2) This figure includes new leases and lease remeasurements excluding peppercorn leases. It excludes the reinstatement of assets at the end of a lease and capitalised dilapidation provisions.

The NHS is committed to investing in the redevelopment of estates to support the delivery of high-quality healthcare and maintain patient safety. As examples of the breadth of schemes that have been developed: in March 2023, Derbyshire Healthcare NHS Foundation Trust broke ground on the development of two new mental health in- patient units being built at the Kingsway Hospital and Chesterfield Royal Hospital sites. The 54 en-suite single rooms in each facility will replace the existing dormitory accommodation. University Hospitals Plymouth NHS Trust opened a new 40 bed, two ward discharge unit at Mount Gould Hospital in March 2023. The unit will enable the trust to discharge medically fit patients to support their recovery and return home and release beds for patients waiting for elective and urgent care. Further information on capital developments in each provider can be found in their annual reports and accounts.

Since 2019 the NHS in England has been undertaking a programme to identify cases of reinforced aerated autoclaved concrete (RAAC) in the NHS estate, a type of building material with an intrinsic risk of failure. Where RAAC is identified, appropriate mitigations are put in place and plans developed for eradication. Earlier phases of the programme focused on sites with the greatest impact, including planning for replacement in the most affected cases under the ‘New Hospitals Programme’. As the programme of work expands, further examples of RAAC have been identified since the 31 March 2023 year end. In all cases where RAAC has been found mitigations have been put in place to manage the impact on service provision. The impact on the valuation of assets at 31 March 2023 cannot be quantified precisely without commissioning new professional valuations.

However using estimation techniques such as assessing the floor area of spaces affected by RAAC in relation to the total floor area of the hospital asset, we are satisfied that the impact on the 31 March 2023 balance sheet is not material to the accounts.

Events after the reporting period

As at 31 March 2023 there were 212 NHS providers. Since this date two NHS providers have been dissolved and their services transferred to existing providers. More details can be found in note 34 to the financial statements. As at the date of authorisation of these accounts, there are 210 NHS providers.

Wider context

More information on the performance of the NHS in 2022/23 and priorities going forward can be found in NHS England’s annual report and accounts.

Amanda Pritchard Chief Executive Officer, 21 January 2024.

Statement of accounting officer’s responsibilities and accountability framework

I am designated as the Accounting Officer for NHS England. In this capacity I am responsible for ensuring that NHS England prepares consolidated NHS provider accounts to send to the Secretary of State and the Comptroller and Auditor General. I am not the accountable/accounting officer for each individual NHS trust/NHS foundation trust; this is the role of each local chief executive. An NHS trust’s chief executive is designated as the accountable officer when their appointment is confirmed by NHS England. NHS foundation trust chief executives are designated as the accounting officer by the NHS Act 2006.

Professor Stephen Powis was the accounting officer for NHS Improvement (being the Monitor and NHS Trust Development Authority legal entities) for the 2021/22 financial year and the first part of the 2022/23 financial year up to 30 June 2022. On 1 July 2022 Monitor and the NHS Trust Development Authority were abolished and their functions transferred to NHS England. I, as Chief Executive of NHS England, received assurances from Professor Stephen Powis at this date.

NHS trusts

The Secretary of State is responsible for determining, with HM Treasury’s approval, the form of accounts each NHS trust must adopt. This is described in the Department of Health and Social Care’s Group Accounting Manual (GAM), which is based on HM Treasury’s Financial Reporting Manual (FReM). NHS England has set out the responsibilities of each NHS trust accountable officer to ensure:

- there are effective management systems in place to safeguard public funds and assets

- the trust achieves value for money from the resources available to it

- the trust’s expenditure and income have been applied to the purposes intended by Parliament and conform to the authorities which govern them

- effective and sound financial management systems are in place

- the Trust’s annual accounts give a true and fair

NHS England has set out the responsibilities of NHS trust directors to:

- apply suitable accounting policies consistently

- make reasonable judgements and estimates

- make a statement within the accounts on whether applicable accounting standards have been followed, and to disclose and explain any material departures and

- prepare the financial statements on a going concern basis and disclose any material uncertainties over going concern.

NHS foundation trusts

NHS England is responsible for determining, with the Secretary of State’s approval, the form of accounts each NHS foundation trust must adopt. The NHS foundation trust annual reporting manual (FT ARM), which is based on the FReM, sets out the responsibilities of each NHS foundation trust accounting officer to:

- apply suitable accounting policies consistently

- make reasonable judgements and estimates

- make a statement within the accounts on whether applicable accounting standards have been followed, and to disclose and explain any material departures

- ensure the use of public funds complies with the relevant legislation, delegated authorities and guidance

- confirm that the annual report and accounts, taken as a whole, is fair, balanced and understandable and provides the information necessary for patients,

regulators and stakeholders to assess the NHS foundation trust’s performance, business model and strategy and

- prepare the financial statements on a going concern basis and disclose any material uncertainties over going concern.

Consolidated NHS provider accounts

In discharging its responsibilities in accordance with the directions to NHS England issued by the Secretary of State, NHS England has prepared consolidated NHS provider accounts on a basis consistent with the individual NHS providers’ accounts and consolidated in accordance with International Financial Reporting Standards (IFRS), as amended for NHS providers by the FReM, the FT ARM and the GAM.

The Secretary of State’s directions require NHS England to prepare these consolidated NHS provider accounts to:

- give a true and fair view of the state of affairs of NHS trusts and foundation trusts collectively as at the end of the financial year and the comprehensive income and expenditure, changes in taxpayers’ equity and cash flows for the financial year then ended

- disclose any material expenditure or income that has not been applied for the purposes intended by Parliament or material transactions that have not conformed to the authorities that govern them.

As far as I am aware, there is no relevant audit information of which the auditors of the consolidated NHS provider accounts are unaware. As Accounting Officer I have taken all the steps I ought to have taken to make myself aware of any relevant audit information and to establish that the auditors are aware of this information.

Amanda Pritchard Chief Executive, 21 January 2024.

Annual governance statement

This annual governance statement (AGS) for the NHS provider sector has been prepared in the context of the accountability framework set out above. It has been prepared as a consolidation of the sector position based on reference to:

- the segmentation of providers under the NHS Oversight Framework

- disclosures in local annual governance statements and

- the audit reports issued by local external

Scope of responsibility

NHS England’s Board is not responsible for the internal control and systems of NHS providers; this is the responsibility of each NHS provider’s board.

NHS trusts

As accountable officer, each NHS trust’s chief executive is accountable to NHS England and is responsible for maintaining a sound system of internal control that supports the achievement of the trust’s policies, aims and objectives. In addition, the chief executive, as accountable officer, has responsibility for safeguarding public funds and the organisation’s assets as set out in the NHS trust accountable officer memorandum.

NHS foundation trusts

As accounting officer, each NHS foundation trust’s chief executive has responsibility to Parliament for maintaining a sound system of internal control that supports the achievement of the trust’s policies, aims and objectives. In addition, the chief executive, as accounting officer, has responsibility for safeguarding public funds and the organisation’s assets as set out in the NHS foundation trust accounting officer memorandum.

Purpose of the system of internal control

NHS England’s system of internal control is designed to support the achievement of its policies, aims and objectives and ensure compliance with legal and other obligations on NHS England and NHS trusts and foundation trusts. As part of this system, NHS England has the following processes to ensure these accounts provide a ‘true and fair’ view of the affairs of NHS providers:

- contributing to the development of guidance to NHS trusts and NHS foundation trusts through the Department of Health and Social Care’s (DHSC’s) Group Accounting Manual (GAM); this has been approved by HM Treasury

- providing guidance to foundation trusts through the NHS foundation trust annual reporting manual (FT ARM); this has been approved by the Secretary of State

- relying on the external auditors appointed by each NHS trust/NHS foundation trust’s council of governors to ensure the truth and fairness of each set of accounts consolidated into these accounts; these auditors have each undertaken an audit in accordance with the Code of audit practice (audit code), issued by the Comptroller and Auditor General, supported by the National Audit Office (NAO)

- appointing the Quality Assurance Directorate of the Institute of Chartered Accountants in England and Wales and Audit Quality Review department of the Financial Reporting Council to review the quality of the work of NHS foundation trust auditors and consider their The audits of NHS trusts are reviewed under similar arrangements by Statute, not overseen by NHS England

- attending the NAO’s Local Auditors’ Advisory Group and associated technical networks, to which senior representatives from each of the audit suppliers appointed as auditors of NHS providers are invited; the forum members discuss technical audit and accounting issues in the public sector, including those concerning NHS bodies and

- consideration by NHS England’s management and by its Audit and Risk Assurance Committee of the consolidated accounts and the processes established to derive them.

Each NHS provider’s annual report and accounts includes an AGS for the year ended 31 March 2023. Each individual AGS explains how the accountable/accounting officer has reviewed the effectiveness of internal control during the period and highlights any significant control issues where the risk cannot be effectively controlled.

Timeliness of local accounts

In preparing the consolidated provider accounts based on consolidation schedules from NHS providers, we are reliant on each provider submitting an audited annual report and accounts to us. We and the Department of Health and Social Care issue directions to NHS providers on the timing by which these should be submitted.

The vast majority of NHS providers and their auditors continued to meet the deadline set for submission of audited accounts in 2022/23 and we recognise the significant efforts by providers and audit firms made to achieve this. The compliance rate was broadly similar to 2021/22, but 2021/22 was a year which showed significant deterioration compared to historic norms. In 2022/23 a small number of provider audited accounts were significantly late; this has delayed the preparation of these consolidated accounts.

There are many reasons why a set of audited accounts may go beyond the deadline: for example this may reflect illness in the preparer finance team or audit team, or a significant issue may be encountered that takes time to resolve, which may reflect weaknesses in a Trust’s preparation of its accounts. It is important that auditors can complete their work independently of outside influence and take the necessary time to ensure their audit opinion is the right one and supported by appropriate audit evidence. However standing back from the level of individual engagements, it is clear that success in enabling providers to achieve the audited accounts deadline, to which all firms sign up collaboratively, varies significantly between audit firms. For example of the five NHS providers audited by one audit firm, only one had submitted audited accounts by 31 August, two months after the deadline.

NHS England continues to work to improve timeliness in financial reporting including:

- encouraging auditors to give clear reporting to audit committees where the preparer’s quality of draft accounts or working papers needs to improve

- working closely with providers to ensure they appoint external auditors in good time, which helps increase the likelihood of deadlines being achieved

- regular engagement with partners including the Department of Levelling Up, Housing and Communities and the Financial Reporting Council on policy matters affecting the broader local audit system: we believe strongly that firms having sufficient capacity across their wider portfolio of work to enable effective interim audits at NHS bodies is important for success

- working with providers where financial reporting issues arise to ensure they are able to address findings effectively

- regular engagement with the audit firms and responding to their feedback to continue to strengthen the NHS financial reporting landscape, and working with partners to make sure training and guidance is available for preparers

- liaising with broader stakeholders on wider matters that can cause delays in NHS accounts, for example sign offs of local government pension scheme audits, which directly affects a handful of NHS providers with a corresponding impact on these consolidated accounts.

We acknowledge that 2022/23 was a complex year for financial reporting and audit in the NHS, in particular the implementation of IFRS 16, the mid-year transition from CCGs to ICBs meaning there was an increased number of bodies in 2022/23 requiring audit, and the growing backlog of audits in local government putting pressure on audit teams. We will continue to take the steps including those outlined above to improve overall timeliness in NHS financial reporting. The Department of Health and Social Care has an ambition to return to laying the main national consolidated accounts (being the DHSC group, NHS England group and consolidated provider accounts) before Parliament in advance of the summer Parliamentary recess in July. Significant improvements in overall timeliness of NHS financial reporting and audit would be required if this is to be achievable in the years ahead.

Overview of internal control systems at NHS trusts and NHS foundation trusts

NHS Oversight Framework

The NHS Oversight Framework for 2022/23 provides the framework for overseeing the delivery of high quality, sustainable care with a focus at both local system and organisational level and identifying potential support needs.

The Framework describes a process to identify where NHS organisations may benefit from or require support to meet the standards required of them in a sustainable way and deliver the overall objectives for the sector in line with the priorities set out in the 2022/23 Operational Planning Guidance, the NHS Long Term Plan and the NHS People Plan.

To provide an overview of the level and nature of support required across systems, inform oversight arrangements and target support capacity as effectively as possible, NHS England regional teams allocate NHS organisations to one of four ‘segments’.

A segmentation decision indicates the scale and general nature of support needs, from no specific support needs (segment 1) to a requirement for mandated intensive support (segment 4). A segment does not determine specific support requirements. By default, all NHS organisations are allocated to segment 2 unless the criteria for moving into another segment are met. These criteria have two components:

a. objective and measurable eligibility criteria based on performance against the six oversight themes using the relevant oversight metrics (the themes are: (i) quality of care, access and outcomes; (ii) people; (iii) preventing ill-health and reducing inequalities; (iv) leadership and capability; (v) finance and use of resources; (vi) local strategic priorities)

b. additional considerations focused on the assessment of system leadership and behaviours, and improvement capability and capacity.

An NHS trust or foundation trust will be placed in segment three or four where it has been found to have significant support needs that may require formal intervention and mandated support. They will be subject to enhanced direct oversight by NHS England (in partnership with their ICB) and, depending on the nature of the problem(s) identified, additional reporting requirements and financial controls.

While NHS trusts were exempt from the requirement to apply for and hold a licence in 2021/22 and 2022/23, NHS England ensured that NHS trusts were treated via equivalent methods to those applied to NHS foundation trusts. This included giving directions where necessary to ensure compliance. NHS trusts were issued licences on 1 April 2023 and from 2023/24 will be subject to the same licence conditions as NHS foundation trusts.

Segmentation of NHS providers is updated regularly. The table below summarises NHS providers’ segmentation as at 31 March 2023. A prior year comparative is not provided as this table provides a snapshot at that point in time and the design and application of the Oversight Framework may evolve over time.

|

Segmentation at 31 March 2023 | ||||

| Number of NHS trusts | Number of NHS FTs | Total number of providers | % of sector | |

|

1 |

10 |

23 |

33 |

16% |

|

2 |

27 |

65 |

92 |

43% |

|

3 |

25 |

44 |

69 |

33% |

|

4 |

6 |

12 |

18 |

8% |

|

Total |

68 |

144 |

212 |

|

NHS providers in segment 3 or 4

Where an NHS provider is triggering a specific concern, NHS England will work with the ICB to understand why this concern has arisen and if a support need exists. Based on this assessment, NHS England will agree the subsequent level of support that is required. Where there is a need for mandated support by NHS England the provider will be placed into segment 3 or 4, depending on the complexity of the support need.

A segment 3 decision will result in a bespoke support offer led by the NHS England regional team drawing on system and national expertise as required.

Segment 4 decisions are reserved for those trusts experiencing long standing complex issues or serious failures in areas such as quality, safety, leadership, governance or financial plans. A segment 4 decision will always trigger a referral to NHS England’s national Recovery Support Programme (RSP). Decisions on referrals into this programme are made by an executive committee of NHS England based on recommendations from Regional Directors or the Care Quality Commission. Where a referral into the RSP for a trust is agreed a dedicated Improvement Director will be appointed to work alongside the Trust leadership as well as the ICB and regional team to oversee the development and delivery of an improvement plan. A diagnostic review will be undertaken to identify underlying drivers that need to be addressed and embed improvement upstream to prevent further deterioration and enable stabilisation.

Enforcement action

Where an NHS provider is in breach of its licence conditions (or where NHS England has reasonable grounds for suspecting a breach), NHS England may also consider the use of its enforcement powers. These powers include, among others, agreeing enforcement undertakings or issuing directions to the provider to secure compliance and ensure the breach does not recur. Details of any enforcement action is publicly available via the Provider Directory on our website.

In exceptional circumstances an NHS trust or NHS foundation trusts may be placed in trust special administration. Administration is a regime for ensuring the continuity of essential services in the event of provider financial distress. No trusts or foundation trusts were subject to trust special administration in 2021/22 or 2022/23.

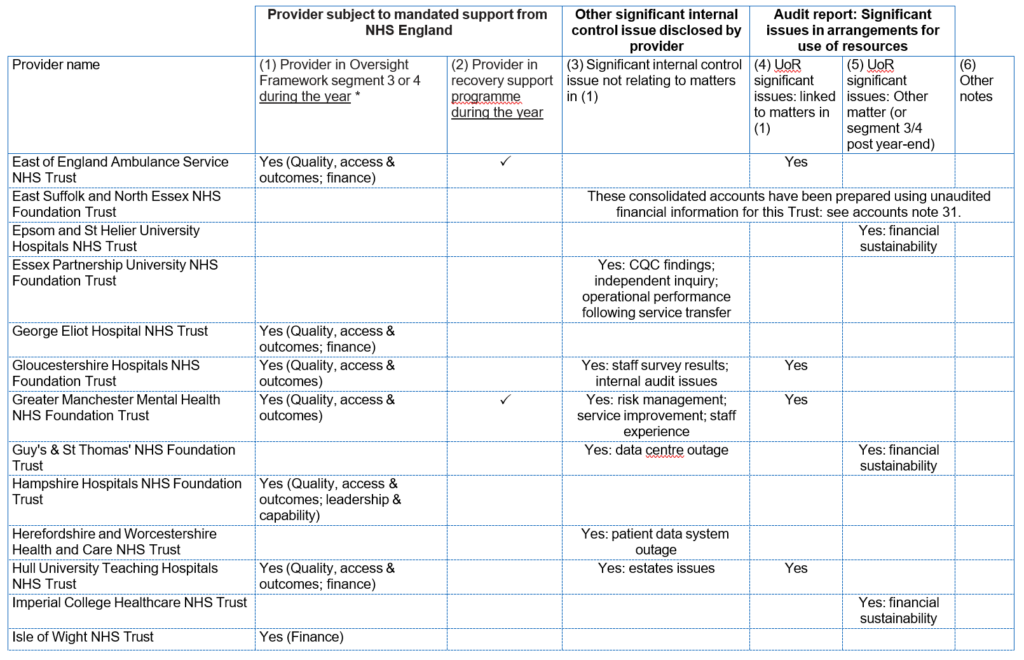

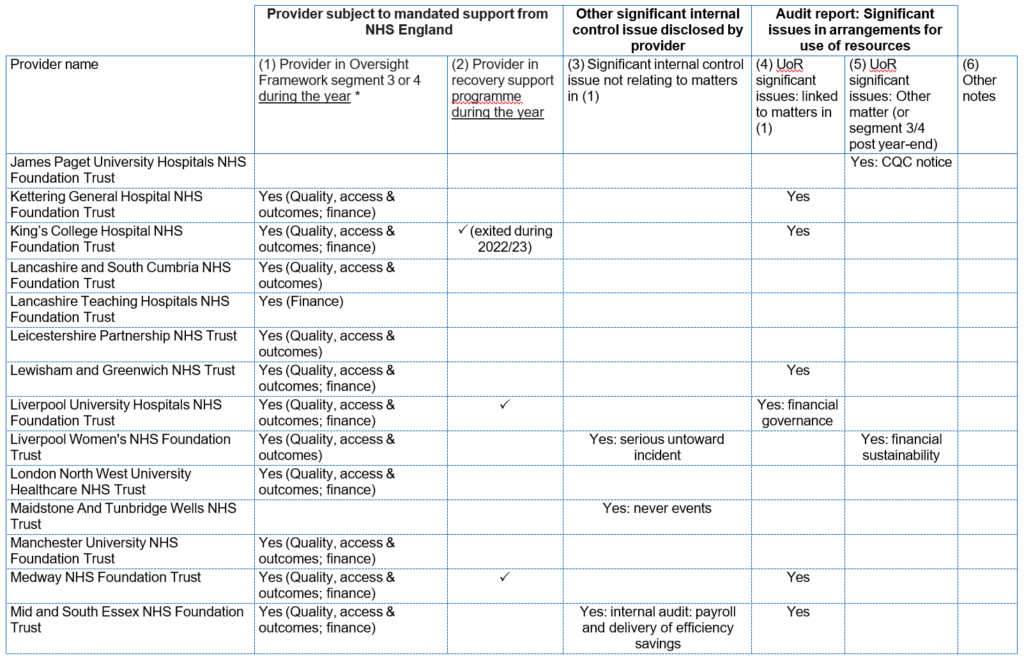

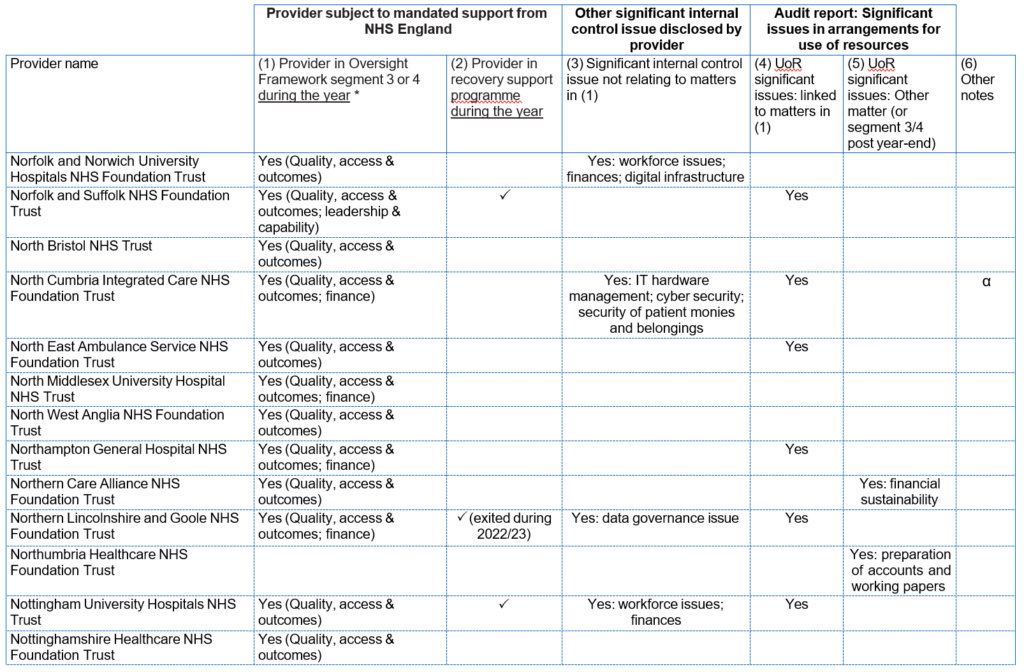

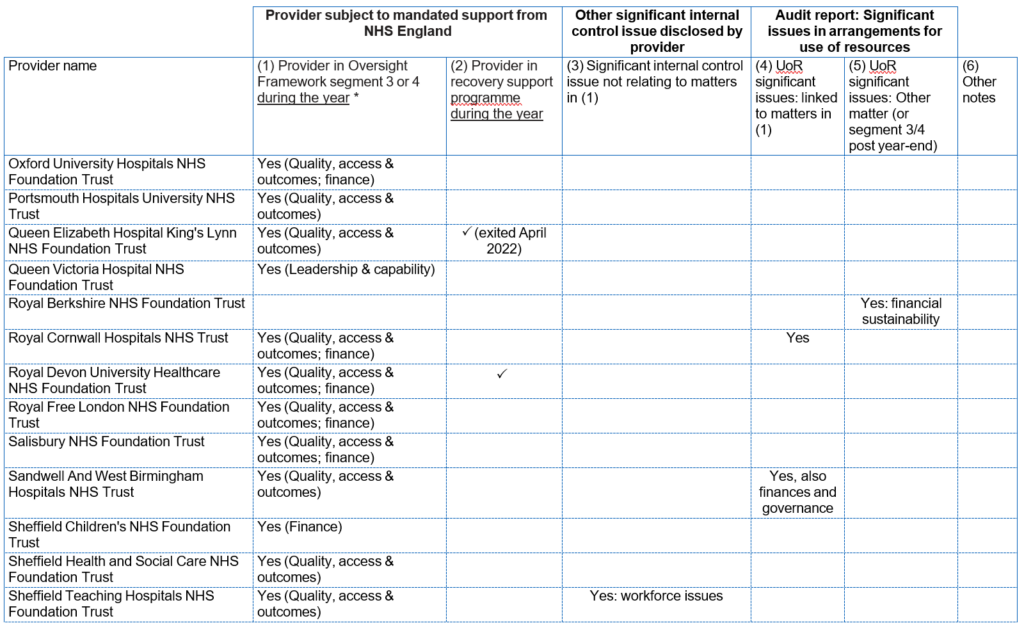

NHS trusts’ and NHS foundation trusts’ significant internal control weaknesses

Sources of information

In the information that follows, NHS England has collated a number of sources of information to disclose the position for NHS providers.

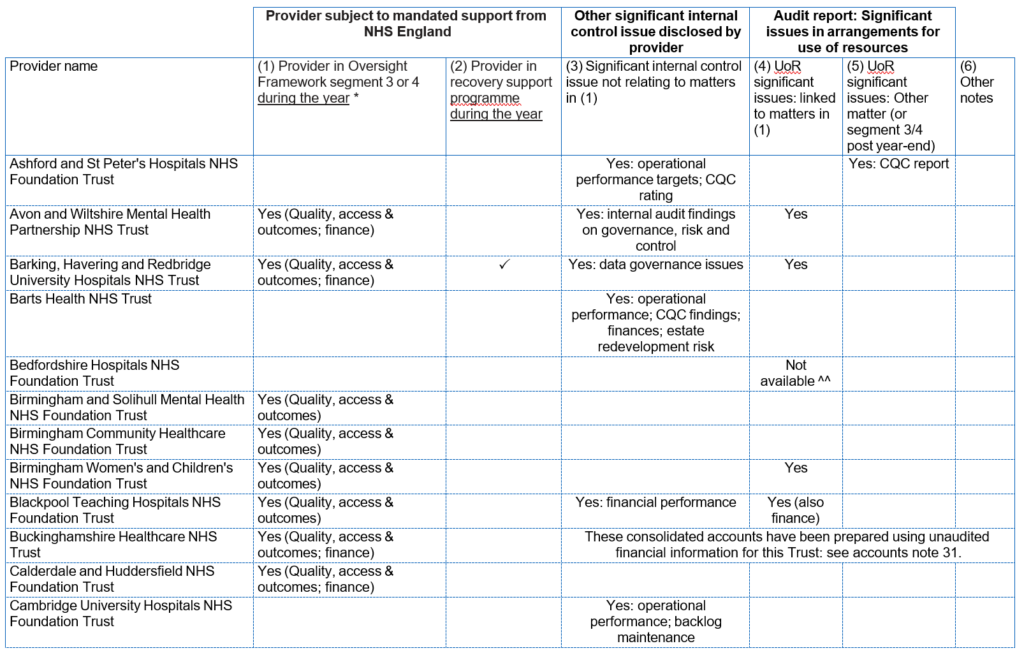

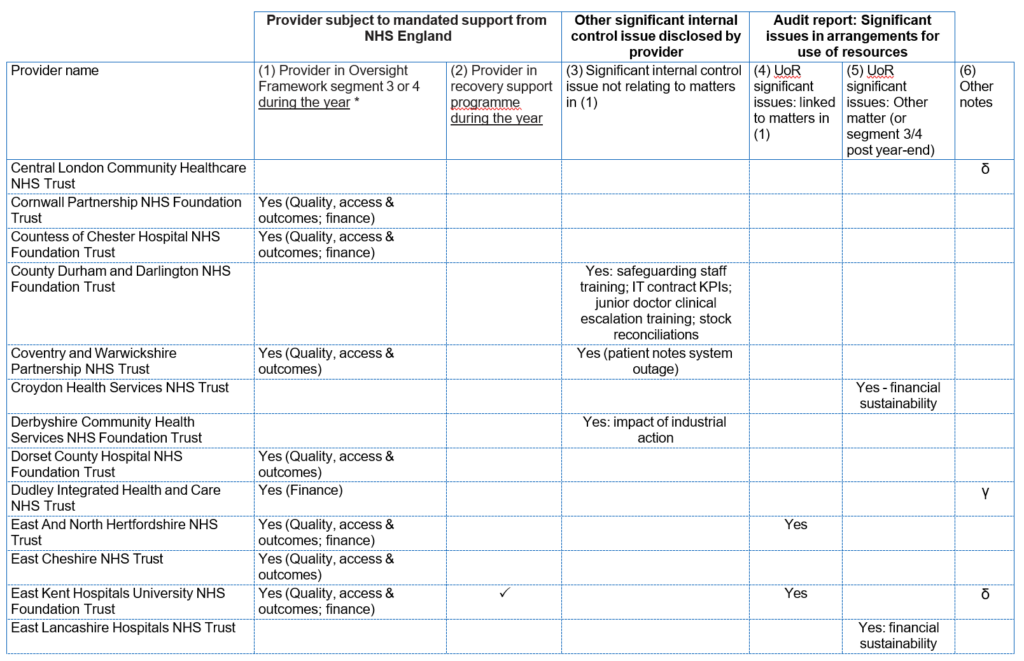

NHS Oversight Framework segment 3 or 4

Where an NHS provider is in Oversight Framework segment 3 or 4 and is receiving mandated support, the support offered to the provider will be defined in terms of the Oversight Framework themes.

NHS England placing an NHS provider into segment 3 or 4 and mandating support would normally indicate the existence of control weaknesses or failings in the trust’s control environment.

Other significant control issues

NHS providers may also declare other matters as significant control issues. NHS England’s FT ARM for NHS foundation trusts and AGS guidance for NHS trusts gives guidance on how to determine whether an internal control matter is ‘significant’ but does not prescribe an approach; this is a matter for each trust’s board. The table that follows includes all cases where trusts have disclosed one or more significant control weaknesses in their annual governance statement.

External auditor’s conclusion on use of resources

In addition to the ‘true and fair’ audit opinion on the accounts, external auditors of NHS trusts and NHS foundation trusts are required to conclude whether the trust has made proper arrangements for securing economy, efficiency and effectiveness in its use of resources. Where the auditor identifies significant issues, the auditor reports that they are unable to satisfy themselves that the trust has made these proper arrangements.

Such reporting does not imply that the ‘true and fair’ audit opinion on the provider’s accounts is qualified. These conclusions are listed in the table that follows. In each case we summarise if this modification relates to the same matters as the reason for Oversight Framework segmentation as 3 or 4 by NHS England

Defining a significant internal control issue for this document

Our starting point for this consolidated annual governance statement is where a trust has locally assessed and disclosed a significant internal control issue in its own annual governance statement.

In addition, regardless of whether these have been reported locally, we also deem the following to be evidence of significant internal control weaknesses:

- NHS Oversight Framework segmentation of 3 or 4 by NHS England during the year

- the external auditor modifying their use of resources

In the table that follows we also disclose notes on other non-standard forms of the auditor’s reporting. We do not consider that entries here necessarily represent a significant internal control weakness.

Summary of results

The table below provides a summary of the detail that follows:

|

2022/23 |

2021/22 | |

|

Number of providers receiving mandated support from NHS England during the year |

94 |

89 |

|

Total number of modified conclusions relating to arrangements for securing economy, efficiency and effectiveness in the provider’s use of resources |

63 |

41* |

|

Number of providers where ‘true and fair’ audit opinion has been modified (qualified) in respect of inventory counts and associated impact |

1 |

19 |

|

Number of providers where ‘true and fair’ audit opinion has been modified (qualified) for another reason |

1 |

1 |

|

Providers consolidated without an audit report |

2 |

Was 3, now 0 |

* There were 40 providers with modified conclusions relating to arrangements for securing economy, efficiency and effectiveness in the provider’s use of resources at the time of finalising the consolidated provider accounts for 2021/22. The audit report for University Hospitals of Leicester NHS Trust was issued in May 2023 and includes a modification to the use of resources conclusion making this final total 41.

Providers consolidated without an audit report

The consolidated provider accounts for 2021/22 describes how that document was finalised with 3 providers not having received their audit report. These have now been subsequently received: Wirral Community Health and Care NHS Foundation Trust in February 2023, Surrey and Sussex Healthcare NHS Trust in March 2023 and University Hospitals of Leicester NHS Trust in May 2023. More information on University Hospitals of Leicester NHS Trust is provided below.

The consolidated provider accounts in 2022/23 have been prepared using unaudited information for two providers as the audit reports remained outstanding at the time of finalising these disclosures on 15 January 2024. These providers are:

- Buckinghamshire Healthcare NHS Trust

- East Suffolk and North Essex NHS Foundation Trust

Individually, the financial statements of the trusts are not material to the consolidated provider accounts and the delay does not reflect any financial reporting or governance matters at the trusts to our knowledge. Some elements of the financial statements are material in aggregate to the consolidated provider accounts. More information is provided in note 31 to the consolidated financial statements.

Modifications of ‘true and fair’ audit opinion: inventory

In 2021/22, 19 providers received audit opinions qualified for a limitation of scope in respect of inventories where sufficient assurance could not be obtained over material inventory balances at a previous year end with impacts on inventory movements in the current or comparative year. Where inventory is material to a provider, international standards on auditing prescribe that the auditor must attend one or more inventory counts. These qualified opinions arose because restrictions on movement in response to the COVID-19 pandemic prevented some providers from performing year-end inventory counts and/or auditors from attending such counts in previous years. For the affected prior year ends, NHS providers were able to employ a variety of procedures to assure themselves of the material accuracy of inventory balances at the year end.

In 2022/23, one provider continued to receive a qualified audit opinion for a limitation of scope for this matter. This arose where the absence of an audited inventory count at 31 March 2021 meant there was uncertainty over the comparative 2021/22 operating expenditure.

The inventory balances at these trusts and associated movements are not material to these consolidated provider accounts. Given the effect of the pandemic, we do not consider a true and fair audit qualification arising from a lack of audit evidence on inventory at the statement of financial position date to constitute a significant internal control issue for the trust.

Modifications of ‘true and fair’ audit opinion: University Hospitals of Leicester NHS Trust

In the consolidated provider accounts for 2021/22 we described the recent history of financial reporting for University Hospitals of Leicester NHS Trust. The Trust’s 2021/22 accounts were subsequently finalised on 15 May 2023 with a qualified audit opinion in two respects: evidence for plant and equipment asset existence, and comparative figures covered by the 2020/21 audit adverse opinion and the impact on the statement of comprehensive income in 2021/22.

The Trust’s 2022/23 accounts were finalised with an audit opinion on 31 August 2023, meeting the target for timing for financial reporting for the Trust set by NHS England and meaning the Trust’s audited accounts have been included in these consolidated accounts. The audit opinion is qualified in two respects: evidence for plant and equipment asset existence, and the impact of additional qualifications in previous years’ financial statements affecting comparative figures for 2021/22. In its auditors’ annual report covering the 2021/22 and 2022/23 financial years, the Trust auditor notes that “progress has been made in responding to the issues with governance and internal control during these two years” but that “as the Trust recognises, there is still a significant way to go to fully address the challenges that the Trust faces”.

The timeliness of the Trust’s financial reporting has notably improved and the scale of qualifications reported by the Trust’s auditors has reduced. However it continues to be the case that local qualified accounts are highly anomalous within the context of NHS bodies. The Trust intends to complete its 2023/24 accounts in line with the national timetable and has a programme of work to achieving the lifting of the qualifications affecting the accounts.

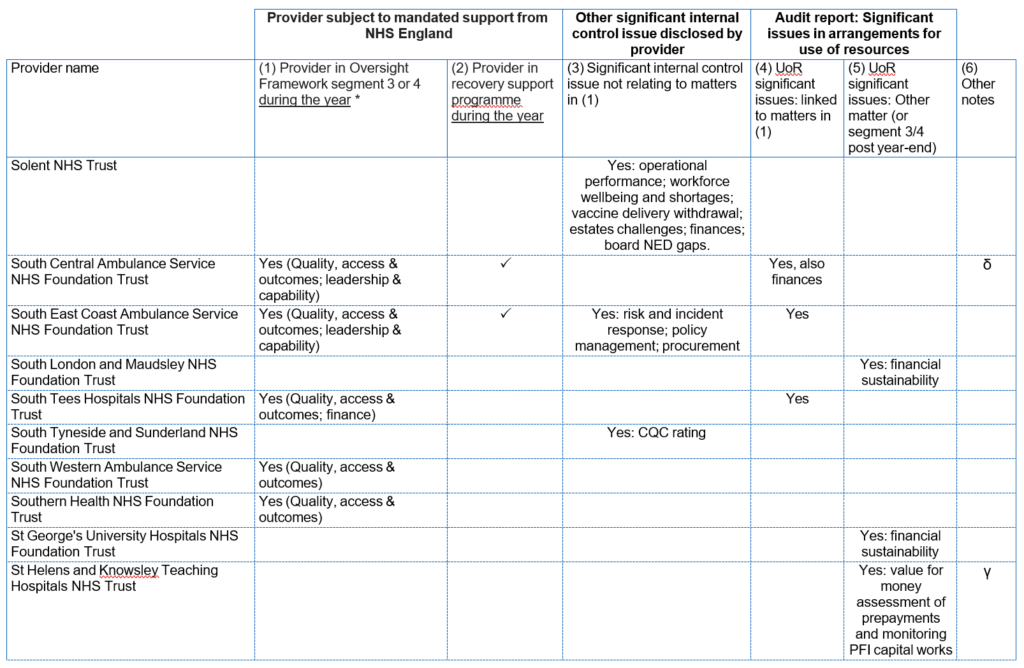

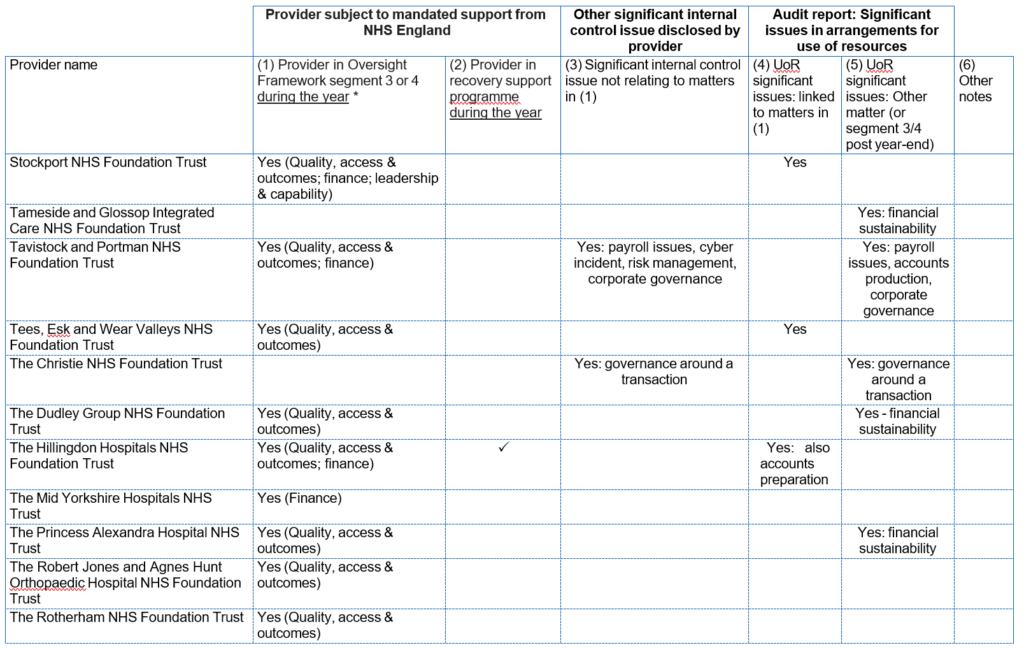

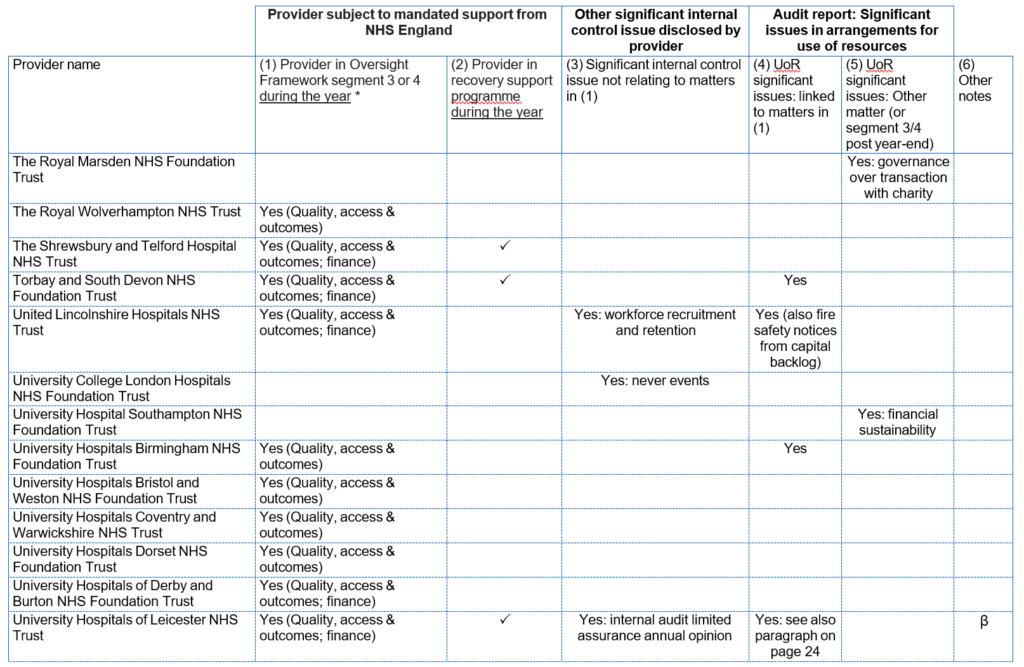

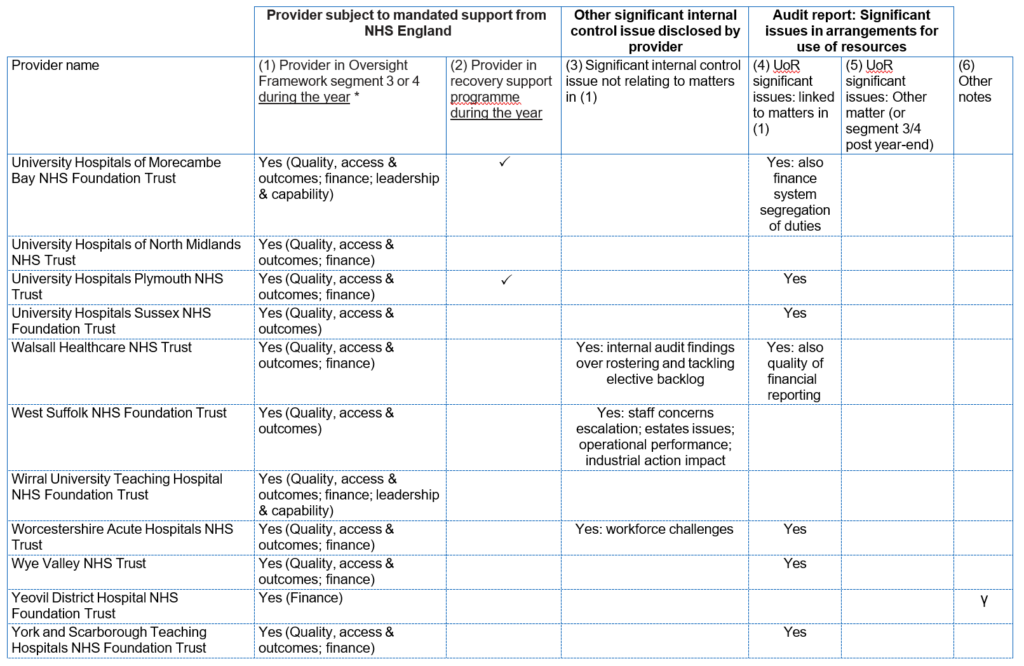

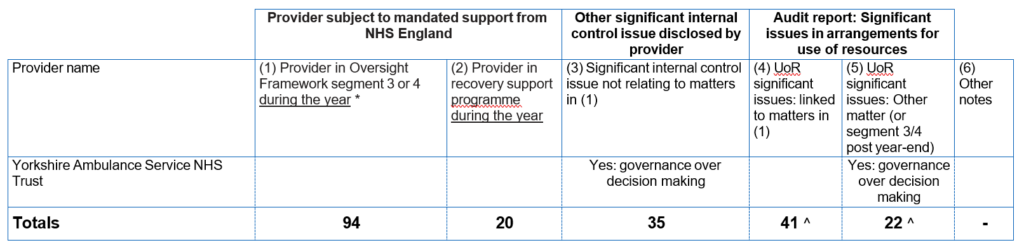

List of providers with matters to report

The tables below list the NHS trusts and NHS foundation trusts for which there are matters to report in the relevant columns. It therefore does not list all NHS providers. Column (3) lists significant internal control issues disclosed in local annual governance statements, excluding matters relating to the same issues as covered by NHS England’s mandated support or individual mentions of the impact of the COVID-19 pandemic. Therefore, the absence of a tick in this column does not necessarily mean the provider disclosed no significant internal control issues in its local AGS.

Notes for column (6) – note we do not consider these items as significant internal control issues:

α 1 provider: modified audit opinion due to inventory counts

β 1 provider: modified audit opinion at University Hospitals of Leicester NHS Trust

γ 3 providers are denoted with this symbol in the table to indicate that the auditor included an ‘emphasis of matter’ relating to the organisation demising or significantly changing its organisational form with services transferring to or from other trusts, either during the reporting year or anticipated in the future

δ 3 providers with modification to audit report relating to remuneration report. Further information is available in the individual trust accounts.

Other notes:

^ No audit report has been issued for Buckinghamshire Healthcare NHS Trust and East Suffolk and North Essex NHS Foundation Trust at the time of finalising the disclosures in these consolidated accounts on 15 January 2024: see above and note 31 to the financial statements.

^^ The auditor’s conclusion on use of resources arrangements had not been issued for Bedfordshire Hospitals NHS Foundation Trust at the time of finalising the disclosures in these consolidated accounts on 15 January 2024.

* Approach for column (1):

- The explanation for each provider shows the support offerings for each provider in segment 3 or 4 at any point during the year. In some cases a trust may receive a combination of mandated and targeted support with all such support needs included here.

- In many cases our support also relates to the leadership and capability theme in the Oversight Where this is the case the underlying issues will usually relate to other themes so this is not always additionally listed here, unless it is a primary matter.

Auditor referrals of matters arising

Under Section 30 of the Local Audit and Accountability Act 2014 for NHS trusts, and under Schedule 10 to the NHS Act 2006 for NHS foundation trusts, where an auditor believes that the body or an officer of the body:

- is about to make, or has made, a decision which involves or would involve the incurring of expenditure which is unlawful, or

- is about to take, or has taken, a course of action which, if pursued to its conclusion, would be unlawful and likely to cause a loss or deficiency

The auditor should make a referral to the Secretary of State (for NHS trusts)/NHS England (for NHS foundation trusts).

37 NHS trusts (2021/22: 384*) and no NHS foundation trusts (2021/22: none) were subject to such referrals in 2022/23. These referrals relate to a failure by the trust to meet the statutory breakeven duty target. This requires an NHS trust to achieve a cumulative breakeven over a three or five-year period. The underlying issues in trust finances are disclosed as part of the detail on significant internal control issues presented above. The statutory breakeven duty does not apply to NHS foundation trusts.

* This figure was 36 at the time of finalising the consolidated provider accounts for 2021/22. Auditors submitted subsequent section 30 referrals relating to the NHS trust breakeven duty at University Hospitals of Leicester NHS Trust in January 2023 and Surrey and Sussex Healthcare NHS Trust in March 2023 which are referenced in 2021/22 audit reports, making this total now 38.

Amanda Pritchard Chief Executive, 21 January 2024.

The certificate of the Comptroller and Auditor General to the Houses of Parliament

Opinion on consolidated financial statements

I certify that I have audited the Consolidated NHS Provider Accounts for the year ended 31 March 2023 under the National Health Service Act 2006.

The Consolidated NHS Provider Accounts comprise the:

- Consolidated Statement of Financial Position as at 31 March 2023;

- Consolidated Statement of Comprehensive Income, Consolidated Statement of Cash Flows and Consolidated Statement of Changes in Equity for the year then ended; and

- the related notes including the significant accounting

The financial reporting framework that has been applied in the preparation of the consolidated financial statements is applicable law and UK adopted International Accounting Standards.

In my opinion, the financial statements:

- give a true and fair view of the state of affairs of NHS trusts and NHS foundation trusts, taken collectively, as at 31 March 2023 and of their deficit for the year then ended; and

- have been properly prepared in accordance with the National Health Service Act 2006 and Secretary of State directions issued thereunder.

Opinion on regularity

In my opinion, in all material respects, the income and expenditure recorded in the financial statements have been applied to the purposes intended by Parliament and the financial transactions recorded in the financial statements conform to the authorities which govern them.

Basis for opinions

I conducted my audit in accordance with International Standards on Auditing (UK) (ISAs UK), applicable law and Practice Note 10 Audit of Financial Statements and Regularity of Public Sector Bodies in the United Kingdom (2022). My responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the financial statements section of my certificate.

Those standards require me and my staff to comply with the Financial Reporting Council’s Revised Ethical Standard 2019. I am independent of NHS England and of NHS trusts and NHS foundation trusts, taken collectively, in accordance with the ethical requirements that are relevant to my audit of the financial statements in the UK. My staff and I have fulfilled our other ethical responsibilities in accordance with these requirements.

I believe that the audit evidence I have obtained is sufficient and appropriate to provide a basis for my opinion.

Conclusions relating to going concern

In auditing the financial statements, I have concluded that NHS England’s use of the going concern basis of accounting in the preparation of the consolidated financial statements is appropriate.

Based on the work I have performed, I have not identified any material uncertainties relating to events or conditions that, individually or collectively, may cast significant doubt on NHS trusts’ and NHS foundation trusts’ collective ability to continue as a going concern for a period of at least twelve months from when the financial statements are authorised for issue.

My responsibilities and the responsibilities of the Accounting Officer with respect to going concern are described in the relevant sections of this certificate.

The going concern basis of accounting for the Consolidated NHS Provider Accounts is adopted in consideration of the requirements set out in HM Treasury’s Government Financial Reporting Manual, which require entities to adopt the going concern basis of accounting in the preparation of the financial statements where it is anticipated that the services which they provide will continue into the future.

Other information

The other information comprises information included in the Consolidated NHS Provider Accounts but does not include the consolidated financial statements nor my auditor’s certificate and report. The Accounting Officer is responsible for the other information.

My opinion on the financial statements does not cover the other information and, except to the extent otherwise explicitly stated in my certificate, I do not express any form of assurance conclusion thereon.

In connection with my audit of the financial statements, my responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements, or my knowledge obtained in the audit, or otherwise appears to be materially misstated.

If I identify such material inconsistencies or apparent material misstatements, I am required to determine whether this gives rise to a material misstatement in the financial statements themselves. If, based on the work I have performed, I conclude that there is a material misstatement of this other information, I am required to report that fact.

I have nothing to report in this regard.

Opinion on other matters

In my opinion, based on the work undertaken in the course of the audit, the information given in the review of financial performance of NHS providers, statement of accounting officer’s responsibilities and accountability framework and the annual governance statement for the financial year for which the financial statements are prepared is consistent with the consolidated financial statements and is in accordance with the applicable legal requirements.

Matters on which I report by exception

In the light of the knowledge and understanding of NHS trusts and NHS foundation trust, taken collectively, and their environment obtained in the course of the audit, I have not identified material misstatements in the review of financial performance of NHS providers, statement of accounting officer’s responsibilities and accountability framework and the annual governance statement .

I have nothing to report in respect of the following matters which I report to you if, in my opinion:

- adequate accounting records have not been kept by NHS England or returns adequate for my audit have not been received from branches not visited by my staff; or

- I have not received all of the information and explanations I require for my audit; or

- the annual governance statement does not reflect compliance with HM Treasury’s guidance

Responsibilities of the Accounting Officer for the financial statements

As explained more fully in the statement of accounting officer’s responsibilities and accountability framework, the accounting officer is responsible for:

- maintaining proper accounting records;

- preparing the information which comprises the review of financial performance of NHS providers, statement of accounting officer’s responsibilities and accountability framework and the annual governance statement in accordance with the National Health Service Act 2006, and with the directions made thereunder by the Secretary of State;

- the preparation of the consolidated financial statements in accordance with the applicable financial reporting framework and for being satisfied that they give a true and fair view;

- such internal controls as the accounting officer determines is necessary to enable the preparation of financial statements to be free from material misstatement, whether due to fraud or error; and

- assessing NHS trusts’ and NHS foundation trusts’ collective ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the accounting officer anticipates that the services provided by NHS trusts and NHS foundation trusts will not continue to be provided in the future.

Auditor’s responsibilities for the audit of the financial statements

My responsibility is to audit, certify and report on the financial statements in accordance with the National Health Service Act 2006.

My objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue a certificate that includes my opinion. Reasonable assurance is a high level of assurance but is not a guarantee that an audit conducted in accordance with ISAs (UK) will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

Extent to which the audit was considered capable of detecting non-compliance with laws and regulations including fraud

I design procedures in line with my responsibilities, outlined above, to detect material misstatements in respect of non-compliance with laws and regulations, including fraud. The extent to which my procedures are capable of detecting non-compliance with laws and regulations, including fraud is detailed below.

Identifying and assessing potential risks related to non-compliance with laws and regulations, including fraud

In identifying and assessing risks of material misstatement in respect of non-compliance with laws and regulations, including fraud, I considered the following:

- the nature of the sector, control environment and operational performance including the design of NHS trusts’ and NHS foundation trusts’ accounting policies and performance

- inquired of management, NHS England’s head of internal audit and those charged with governance, including obtaining and reviewing supporting documentation relating to NHS England’s policies and procedures on:

- identifying, evaluating and complying with laws and regulations and whether they were aware of any instances of non-compliance;

- detecting and responding to the risks of fraud and whether they had knowledge of any actual, suspected, or alleged fraud; and

- the internal controls established to mitigate risks related to fraud or non-compliance with laws and regulations including NHS England’s controls relating to NHS England’s compliance with the National Health Service Act 2006 and Managing Public Money.

- discussed with the engagement team regarding how and where fraud might occur in the consolidated financial statements and any potential indicators of fraud.

As a result of these procedures, I considered the opportunities and incentives that may exist within NHS trusts and NHS foundation trusts for fraud and identified the greatest potential for fraud in the following areas: revenue recognition, posting of unusual journals, complex transactions, and bias in management estimates. In common with all audits under ISAs (UK), I am also required to perform specific procedures to respond to the risk of management override.

I obtained an understanding of NHS trusts’ and NHS foundation trusts’ framework of authority as well as other legal and regulatory frameworks in which NHS trusts and NHS foundation trusts operate, focusing on those laws and regulations that had a direct effect on material amounts and disclosures in the financial statements or that had a fundamental effect on the operations of NHS trust and NHS foundation trusts. The key laws and regulations I considered in this context included the National Health Service Act 2006, the Health and Social Care Act 2012, the Health and Care Act 2022, Managing Public Money, employment law, and tax legislation.

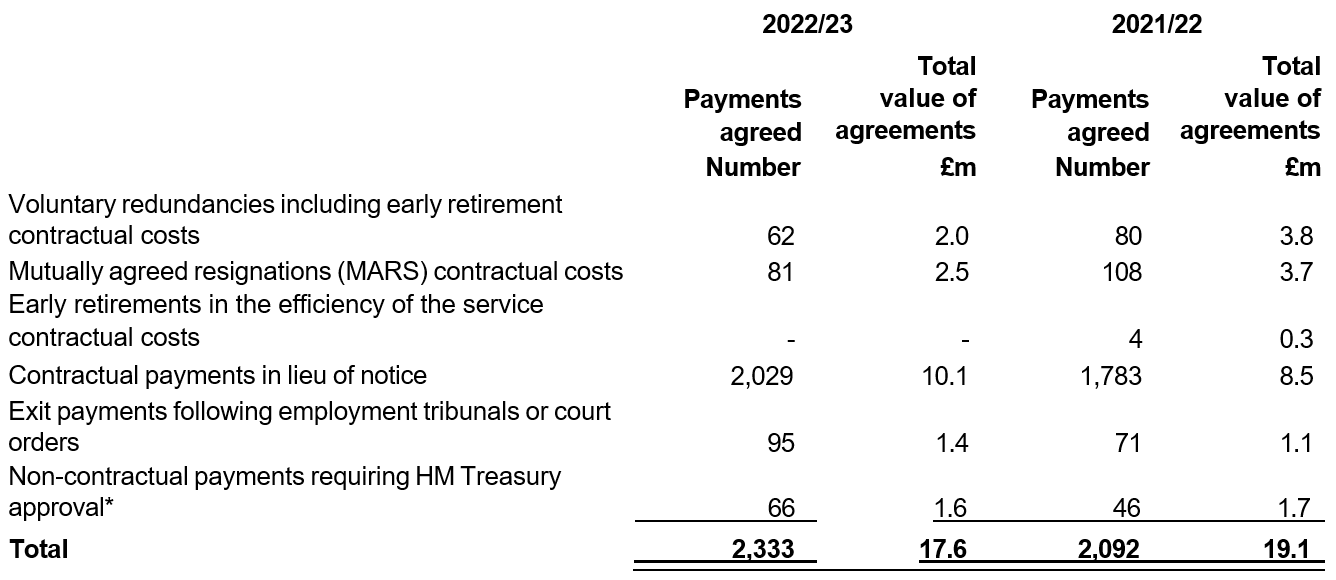

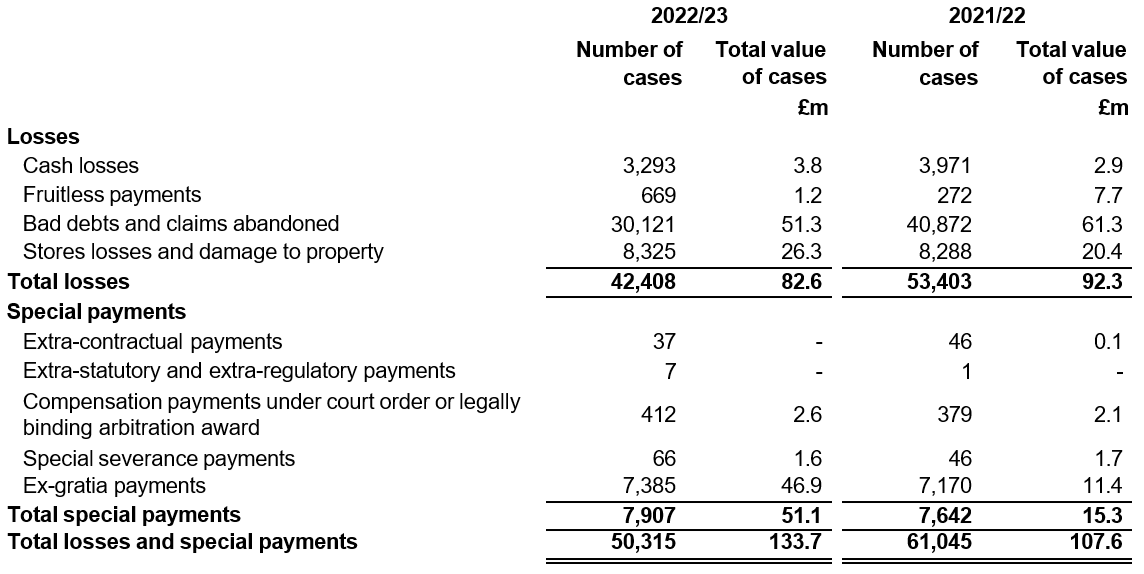

In addition, I considered regulations and regularity relating to exit packages and, in particular, special severance payments, as I identified the completeness and regularity of special severance payments as a significant risk.

Audit response to identified risk

To respond to the identified risks resulting from the above procedures:

- I reviewed the financial statement disclosures and testing to supporting documentation to assess compliance with provisions of relevant laws and regulations described above as having direct effect on the financial statements;

- I enquired of management and the Audit and Risk Assurance Committee concerning actual and potential litigation and claims;

- I reviewed minutes of meetings of those charged with governance and the board and internal audit reports;

- in addressing the risk of fraud through management override of controls, testing the appropriateness of journal entries and other adjustments; assessing whether the judgements made in making accounting estimates are indicative of a potential bias; and evaluating the business rationale of any significant transactions that are unusual or outside the normal course of business; and enquiring with the auditors of NHS trusts and NHS foundation trusts about the findings of their audits with respect to management override of control; and

- in addressing the risk of fraud in revenue recognition, I notified the auditors of NHS trusts and NHS foundation trusts of the need to consider the presumed risk of fraud in revenue recognition and enquired with them around the findings of their audits with respect to fraud in revenue recognition.

I communicated relevant identified laws and regulations and potential risks of fraud to all engagement team members and remained alert to any indications of fraud or non-compliance with laws and regulations throughout the audit.

A further description of my responsibilities for the audit of the financial statements is located on the Financial Reporting Council’s website at: www.frc.org.uk/auditorsresponsibilities. This description forms part of my certificate.

Other auditor’s responsibilities

I am required to obtain evidence sufficient to give reasonable assurance that the expenditure and income recorded in the financial statements have been applied to the purposes intended by Parliament and the financial transactions recorded in the financial statements conform to the authorities which govern them.

I communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control I identify during my audit.

Gareth Davies, Comptroller and Auditor General

22 January 2024

National Audit Office

157-197 Buckingham Palace Road Victoria

London SW1W 9SP

Report of the Comptroller and Auditor General to the Houses of Parliament

Introduction

1. The National Health Service Act 2006 requires NHS England to prepare a Consolidated NHS Provider Accounts (“CPA”) for each financial The CPA is a consolidation of the 212 NHS trusts and NHS foundation trusts (“NHS providers”). The CPA is in turn consolidated into the Department of Health and Social Care (DHSC) group accounts. I consider the CPA to be a significant component of DHSC and my audit of the CPA must be complete before I complete my audit of DHSC.

2. I am required to examine, certify, and report on the I provide an opinion on whether the CPA gives a “true and fair” view of the finances of NHS providers, taken collectively. I also provide an opinion on whether the transactions recorded in the CPA have been applied to the purposes intended by Parliament and whether they conform to the authorities which govern them (“regularity”).

3. In this report I set out my observations on the performance of NHS providers in delivering accounts to support the timely production of the CPA.

Audit completion delays of NHS providers

4. NHS providers are audited by a number of different audit firms. NHS providers are free to appoint their external auditors (“local auditors”). Local auditors must comply with the Code of Audit Practice (“the Code”). Under the Local Audit and Accountability Act 2014, I am responsible for the preparation, publication, and maintenance of the Code. The Code sets out what local auditors are required to do to fulfil their statutory responsibilities under the Local Audit and Accountability Act 2014. For 2022-23 the NHS provider audits were undertaken by nine audit firms.

5. The Code stresses the need for local auditors to report on a timely basis. Section 1.19 of the Code requires local auditors to report on a timely basis. Timely reporting includes producing audit reports in time, insofar as the auditor can do so under auditing standards, to allow local bodies to comply with the requirements placed on them to publish their audited financial statements. It also means ensuring that when matters of concern arise during the audit, the auditor raises them promptly with the body and considers whether the matter needs to be brought to public attention at the appropriate time.

6. The timetable set by NHS England and DHSC for the 2022-23 group accounts required local auditors to complete the statutory audits of NHS providers by 30 June 20232. The statutory deadline, under the Government Resources and Accounts Act 2000, requires government departments to lay their annual reports and accounts in Parliament by 31 January, ten months after the financial year end. Although the CPA does not have a statutory deadline for being laid in Parliament, as the CPA is a significant component of the DHSC group, the CPA accounts must be completed to the same timetable as DHSC.

7. DHSC committed to laying their 2022-23 annual report and accounts before the end of 2023. At a Public Accounts Committee hearing on 20 March 2023, regarding the timeliness of the DHSC annual report and accounts 2021-22, DHSC committed to aiming to lay its 2022-23 accounts before the 2023 Parliamentary Christmas recess and then to gradually improve the timeliness in future years. DHSC’s stated aim was to bring forward the laying date by two months each year to eventually enable laying before the Parliamentary summer recess. Before the Covid-19 pandemic, DHSC and NHS England (covering both the NHS England group account and the CPA) routinely laid their annual reports and accounts in Parliament before the Parliamentary summer The last time this happened was for the 2018-19 annual report and accounts. For the 2022-23 accounts, NHS England, DHSC and my staff agreed a target date of 30 November 2023 for audit certification of the CPA, to enable laying before the 2023 Parliamentary Christmas recess.

8. Of the 212 NHS providers, 163 had their 2022-23 annuals report and accounts audited by 30 June 2023. 163 NHS provider audits were completed by 30 June 2023, meaning just over three quarters of NHS providers achieved the target date set by NHS England. By 31 October 2023, 203 (95.8%) NHS provider audits were This was the latest practical date to enable certification of the CPA and DHSC annual report and accounts by 30 November 2023.

9. At the point NHS England finalised the CPA, two NHS provider audits remained outstanding, and these entities account for material transactions and balances in the CPA. By Christmas 2023, 210 NHS provider audits were completed, with the remaining two audits outstanding as the CPA was finalised. NHS England has had to perform alternative procedures to obtain sufficient assurance that the material transaction streams in the outstanding NHS providers are not materially misstated, in the context of the CPA. My staff have reviewed the procedures performed by NHS England and are content that in the context of the CPA, the results are sufficient and appropriate. I have therefore issued a clean “true and fair” audit opinion in respect of the CPA 2022-23. Note 31 to the accounts provides details of the transactions and balances relating to these two NHS providers.

10. NHS England clearly recognises the risks that late auditor reporting can represent and has been proactive in using its influence to support NHS providers and local auditors with timely delivery. As set out in the annual governance statement, NHS England demonstrates a clear understanding of the risks around late auditor reporting, including the delays this has caused to the laying of its own annual report and accounts. NHS England has set out the range of interventions they have used to support NHS providers and local auditors to try and accelerate the audit of NHS provider accounts and it is critical this work continues for 2023-24.

11. In 2023-24 NHS England should continue its role in proactively monitoring audit progress of NHS provider accounts. NHS England has been proactive in 2022-23 in monitoring the progress of late NHS provider accounts, including engaging with the local auditors, my staff, HM Treasury and the Financial Reporting Council (which regulates local audit firms). NHS England remain concerned about the capacity of local auditors to bring forward certification to enable the CPA, and hence DHSC, to lay their annual reports and accounts in Parliament significantly earlier than has happened over the last four financial years.

12. I also have concerns given the wider local audit challenges set out in my report, Timeliness of local auditor reporting on local government in England4. There could still be some risk in the delivery of NHS local audits due to the wider local audit system issues and significant delays in local government audits as the auditors work to clear this blacklog.

Gareth Davies, Comptroller and Auditor General

22 January 2024

National Audit Office

157-197 Buckingham Palace Road Victoria

London SW1W 9SP

Consolidated statement of comprehensive income for the year ended 31 March 2023

table

Consolidated statement of financial position as at 31 March 2023

Table

* A new leasing standard, IFRS 16 Leases , was implemented on 1 April 2022. Right of use assets and borrowings are the only materially impacted financial statement line items. See note 14.6 for more information.

The accompanying notes are an integral part of these accounts.

Amanda Pritchard, Accounting Officer, 21 January 2024.

Consolidated statement of changes in equity for the year ended 31 March 2023

* These adjustments reflect local NHS providers’ adjustments to prior year reserves. The aggregated adjustments are not considered material to the consolidated provider accounts and so prior year balances have not been restated.

** Other reserve movements includes a transfer between charitable funds and NHS provider income and expenditure reserves representing a transfer of resources eliminated from income and expenditure on consolidation.

Consolidated statement of changes in equity for the year ended 31 March 2022

* These adjustments reflect local NHS providers’ adjustments to prior year reserves. The aggregated adjustments are not considered material to the consolidated provider accounts and so prior year balances have not been restated.

** Other reserve movements includes a transfers between charitable funds and NHS provider income and expenditure reserves representing a transfer of resources eliminated from income and expenditure on consolidation.

Information on reserves

Public dividend capital

Public dividend capital (PDC) is a type of public sector equity finance based on the excess of assets over liabilities at the time of establishment of an NHS trust, or predecessor NHS trust where PDC is recognised by a foundation trust. Additional PDC may also be issued to NHS providers by the Department of Health and Social Care to fund capital investment or support operating cash flows. A charge, reflecting the cost of capital utilised by an NHS provider, is payable to the Department of Health and Social Care as the PDC dividend.

Revaluation reserve

Increases in asset values arising from revaluations are recognised in the revaluation reserve, except where, and to the extent that, they reverse impairments previously recognised in operating expenses, in which case they are reversed in operating expenses. Subsequent downward movements in asset valuations are charged to the revaluation reserve to the extent that a previous gain was recognised unless the downward movement represents a clear consumption of economic benefit or a reduction in service potential.

Other reserves

This reserve reflects balances formed on the creation of predecessor NHS bodies, and in some historic mergers before the use of transfer by absorption. Other reserves also include non-controlling interests. Non- controlling interests represent the equity in a subsidiary of an NHS provider which is not attributable, directly or indirectly, to the NHS provider.

Income and expenditure reserve

The balance of this reserve represents the accumulated surpluses and deficits of NHS providers.

NHS charitable funds reserves

This balance represents the ring-fenced funds held by the NHS charitable funds consolidated within these financial statements. These reserves are classified as restricted or unrestricted and a breakdown is provided in note 27.

Consolidated statement of cash flows for the year ended 31 March 2023

table

Total cash and cash equivalents is reconciled to the consolidated statement of financial position in note 17.1.

Cash flows from discontinued operations are not material so are not shown separately on the face of the consolidated statement of cash flows.

Notes to the financial statements

Note 1 Accounting policies and other information

Basis of preparation

Paragraph 1 of Section 65Z4 of the National Health Service Act 2006 (as inserted by Section 14 of the Health and Care Act 2022) requires NHS England to prepare a set of accounts that consolidates the annual accounts of all NHS trusts and NHS foundation trusts for each financial year. This set of accounts is termed the ‘consolidated provider accounts’ and is prepared in accordance with directions issued by the Secretary of State. In line with those directions, these accounts have been prepared in accordance with the Department of Health and Social Care (DHSC) Group Accounting Manual (GAM) 2022/23 and the HM Treasury Financial Reporting Manual (FReM) in relevant respects. ‘NHS providers’ is used as a collective term for NHS trusts and NHS foundation trusts. ‘Trusts’ when not prefixed with ‘NHS’ is also used to mean providers in general.

NHS England is responsible for issuing an accounts direction to NHS foundation trusts under the NHS Act 2006. NHS England directs that the financial statements of NHS foundation trusts shall meet the accounting requirements of the GAM. The GAM is directly applicable to NHS trusts as a result of directions issued by the Secretary of State.