Organisation objective

- Statutory item

- NHS Long Term Workforce Plan

- NHS Long Term Plan

Working with people and communities

What approaches have been used to ensure people and communities have informed this programme of work?

- Recruited patient and public voice (PPV) partners

- Consultation/engagement

- Partnership working with voluntary, community and social enterprise organisation

PPV is embedded into our research programmes of work via work with our recruited PPV partners. We are working directly with voluntary, community and social enterprise partners to deliver the research engagement network to increase diversity in research participation and via the data for Research and Development Programme we have funded large scale public deliberation programme to ensure the public voice informs our work on data driven research.

Action required

The Board is asked to discuss the following questions and provide a steer to support development of our plans in our next phase of work:

1. How could NHS England consistently signal support for embedding research into everyday NHS care – what national levers could be used, for example, planning guidance?

2. What support can the board offer to address the current challenges particularly on the issues around the research workforce (paragraph 16)?

3. What would be the most helpful measures for the board to understand integrated care system research performance (in addition to National Institute for Health and Care Research (NIHR)/Department of Health and Social Care key performance indicators) and is the board supportive of working with NIHR to explore the possibility of NIHR financial incentives?

Background

1. The benefits of research in the NHS are well documented:

a. Patients benefit from earlier access to new treatments and technologies and the NHS benefits from evidence on effectiveness and cost effectiveness.

b. Research active hospitals have lower mortality rates and patients’ perception and experience of care is higher in research active organisations.

c. Staff have increased job satisfaction and NHS employers can improve recruitment and retention when staff are enabled to be involved in research.

d. The NHS generates income from commercial clinical trial activity.

2. Our ambition is for the NHS to be the best place in the world to undertake research for patient benefit and to develop and sustain a vibrant research ecosystem driving growth in the UK life sciences industry – and by extension jobs and economic growth. This will enable the NHS to address some of its challenges by enabling better outcomes through advances in diagnosis and treatment, taking a proactive approach to prevention, and delivering transformative change by re-engineering health care pathways.

England’s current performance

3. Prior to the pandemic the UK was falling down the league tables of international competitiveness for commercial trial activity (for phase III trials from 4th in 2017 to 10th in 2021), and we saw slow recovery in research activity following the acute phase of the pandemic. A report by the Association of British Pharmaceutical Industries from 2023 highlighted that recruitment figures for commercial research in 2022/23 were 27% lower than in 2017/18

4. Significant effort has been made to recover this position, with NHS England and the Department of Health and Social Care jointly launching the Research Reset Programme, which galvanised research sponsors and NHS organisations to ensure their portfolios were delivering to time and target. There has also been a significant response from the sector to meet the commitments in the government’s response to Lord O’Shaughnessy’s review, which was commissioned to address the significant concerns around commercial trial activity.

5. As part of this response, the National Institute for Health Research (NIHR) have developed new key performance indicators (KPIs) to measure research performance in the NHS (see annex 1 for details on research activity and March KPIs and annex 2 for recruitment figures for England only). For March 2024, the average monthly recruitment to all studies was 88,402, compared to a pre-pandemic baseline of 61,000, and average monthly recruitment to commercial studies was 10,974, compared to 3,200.

6. While there is good news in terms of the total number of participants being recruited into commercial research, the numbers recruited into interventional studies is starting to decline again, and delivery of time to target (studies running on time and recruiting the number of participants as planned) is also slipping. 70% of studies in March this year compared to 82% in October 2023. It is important to ensure that NHS organisations are not prioritising studies that purely boost recruitment numbers (because that is what they have heard is most important) over more complex interventional studies that benefit patients and that industry want us to deliver

Interdependencies and wider implications

NHS England’s role

7. NHS England made specific commitments in relation to research in the NHS Long Term Plan. In addition, it has committed to work in partnership across the research ecosystem to deliver commitments in government strategies, including the Life Sciences Vision, Saving and improving lives: the future of UK clinical research delivery, and the government’s response to the Lord O’Shaughnessy review of commercial research delivery.

8. We have a specific and distinct role to play in this ecosystem that is complementary but separate from those of our partners. Specifically, the Department of Health and Social Care (DHSC) and the National Institute for Health and Care Research (NIHR) are responsible for:

a. funding high quality, timely research

b. investing in world-class expertise, facilities and a skilled delivery workforce

c. attracting, training and supporting the best researchers

d. collaborating with other public funders, charities and industry to help shape a cohesive and globally competitive research system

e. establishing and developing world leading research infrastructure

f. monitoring and managing research performance in relation to the NIHR portfolio.

9. NHS England is a key partner in the DHSC Research Recovery, Resilience and Growth (RRG) Programme, which provides cross agency oversight of the delivery of the commitments in the government strategies.

10. NHS England has statutory duties to facilitate or otherwise promote research in the NHS, as well as the use of research evidence. Integrated care boards (ICBs) have similar duties and must report to NHS England on how they fulfil these in their joint forward plans and annual reports. The NHS Constitution gives patients the right to be informed about research opportunities. The new draft NHS Constitution, which is currently out for consultation, goes further in stating that “the offer to be part of research should be integrated into health and care across the NHS”. As well as having specific duties, NHS England is in a strong position for convening the system, and we have used this power previously to bring partners together on areas of operational policy that were significant blockers to delivery of research, such as excess treatment costs and national contract value review. We have an opportunity to use this power more strategically and drive the agenda for more partnerships and the delivery and design of research that specifically address the NHS’s needs.

Work being undertaken in NHS England

11. To support systems to exercise their duties NHS England has published guidance for ICBs, which recommends each system develops a research strategy and has a board representative who is responsible for research. To date, 3 ICBs have published final strategies with 2 published in draft. This indicates that research activity is being driven by providers and not currently by the ICBs. We also recently published a best practice guide for managing research finances and supporting growth of research capability and capacity.

12. The research portfolio team in the Transformation Directorate hold the responsibility (in the main) for NHS England’s work in this space, which is driven by our ambition to increase the diversity, scale and pace of research in the NHS:

a. Diversity – establishing trusted engagement networks in every ICS footprint working with underserved communities to reduce health inequalities by increasing diversity in research participants and addressing specific systemic barriers to taking part in research.

b. Scale and pace – by introducing a single costing and contracting mechanism (national contract value review), mandated via the NHS standard contract, we have reduced study setup time for commercial research by over a third.

c. Our data for Research and Development Programme is building the infrastructure and system capabilities to deliver data driven research at scale and at pace via a standard operating model for the NHS Research Secure Data Environments’ Network and a single front door approach.

d. The NHS DigiTrials offer is supporting faster at scale recruitment for priority studies such as the NHS Galleri trial where 140,000 participants were recruited in only 10 months.

e. We are growing a significant registry of patient and public volunteers who wish to take part in research. 465,807 volunteers have now registered on NIHR’s Be Part of Research registry, of whom 79% registered via the link on the NHS App.

f. There is strong cross organisation collaboration to ensure a multiprofessional approach is embedded into our work and particularly to development of the research workforce. In 2021, the NHS in England published the Chief Nursing Officer’s strategy for research and the Allied health professionals’ research and innovation strategy. This year the nursing directorate have also published a number of supporting frameworks: Multiprofessional practice-based research capabilities framework and Self assessment of organisational readiness tool.

g. We are developing a robust function for identification of NHS England’s research needs via our demand signalling approach to ensure that we can influence the allocation of public funding for our priority research needs. Our demand signalling reports for stroke and mental health research needs have generated 11 funding calls into stroke research and 29 research and innovation projects for mental health.

h. In both the NHS Long Term Plan and the response to the O’Shaughnessy review, we committed to the development of research metrics and measures to help systems understand their research performance. This work has recently begun and we are keen to understand the board’s view on what these measures should be.

13. NHS England is also playing a significant role in delivery of the government’s strategic partnerships with Moderna and BioNTech. Our work across increasing diversity, scale and pace for research positively impacts delivery of these companies’ clinical trials in England and we have specific commitments to implement national contract value review in trials for advanced therapeutic medicinal products and early phase trials in the agreement with BioNTech.

Current challenges

14. Research can be seen as a “nice to have”, and in challenging operating environments can be deprioritised despite the evidence of significant benefits. Staff can be diverted from research activity to deliver direct care, which impacts both study setup times and predictability of trial delivery. This is likely to be influencing the trend we are starting to see in the move to observational versus interventional commercial study activity.

15. Research workforce: the need to develop and grow the research workforce in the NHS is recognised in the Vision for UK Clinical Research Delivery and the response to the Lord O’Shaughnessy review. There has been a significant decline in the number of consultant clinical academics in the NHS and there is a need for defined and supported career pathways for the multiprofessional research workforce that work in alignment with higher education institutions. There are also specific shortages in the NHS workforce, such as those in radiology and pharmacy, that impact on trial delivery more generally. The NHS Long Term Workforce Plan commits to working with partners to explore how best to address the issues relating to research workforce careers. NHS England has begun internal discussions on how to progress this commitment and we would value the board’s support to focus work on development of the research workforce this year. We are also working with the RRG on the government’s commitment to publish a research workforce plan in the autumn.

16. Research in primary care: As the focus of delivery of services shifts from secondary care to local communities it is vital that patients can get access to research in primary care services and ICBs must consider their research offer to patients across all pathways. There are only a small number (approximately 3%) of GP practices that undertake commercial research and we should be ambitious in our expectations to increase this number as well as working with community pharmacy to understand better the role they can play in delivery of clinical trials.

17. NHS England does not currently directly incentivise activity in research. There is the potential to work with DHSC/NIHR to consider how we might do this and discuss if NIHR financial incentives should be introduced. We are keen to understand the board’s position on if this should be pursued.

Annex 1: research activity in NHS organisations and National Institute for Health Research key performance indicators introduced in October 2023 in response to the Lord O’Shaughnessy review

Research activity across NHS organisations varies. In 2022/23, 100% of NHS acute trusts recruited patients into the National Institute for Health Research (NIHR) portfolio studies with 74% recruiting into commercial contract studies. 94% of ambulance, care and mental health trusts also recruited but only 44% of general practices recruited into studies.

With the exception of combined review (1), all UK performance indicators measure UK-wide performance for studies on the NIHR Clinical Research Network portfolio. The indicators apply at a UK system-wide level and implementation will be overseen by the Department of Health and Social Care, the devolved administrations and the NHS.

|

|

|

NHS.UK performance indicator |

Target |

Timeline for delivery |

Baseline [1] |

March 2024 |

|

1 |

All [2] | Proportion of studies receiving combined regulatory review achieved within 60 days, measured from the Integrated Research Application System submission to combined Medicines and Healthcare products Regulatory Agency and Research Ethics Committee regulatory decision |

99% |

Maintain target for all new fully compliant initial applications received from 1 September 2023 |

100% |

Final outcomes communicated in an average of 26.5 days |

|

2 |

C [3] | Proportion of studies open to recruitment within 60 days of Health Research Authority approval letter or equivalent process used by the devolved administrations |

90% |

November 2024 |

39% |

47% |

|

3 |

C |

Proportion of studies recruiting first participant within 30 days of sites opening to recruitment, except where this is not expected in the study milestone plan (for example, rare diseases studies) |

90% |

November 2024 |

25% |

8% |

|

4 |

C | Proportion of NHS trusts in England who accept the local price generated as part of the national contract value review process for late-phase studies without further negotiation following agreement of the resource required by the lead site |

100% |

December 2023 |

79% |

100% |

|

5 |

All |

Proportion of open studies on track, delivering to time and target |

80% |

June 2023 |

80% |

77% [4] |

|

6 |

All |

Recruitment to all studies is maintained at high levels when compared to pre-pandemic baseline of 61,000 [5,6] |

70,000 or more per month [7] |

Ongoing |

70,000 |

88,402 [8] |

[1] Some measures are new and therefore the baseline was established in different months.

[2] All indicates a measure that applies to all studies.

[3] C’ indicates that it applies to commercial contract studies only.

[4] Based on recruitment in UK and England target.

[5] Average per month in England only from 2015 to 2020.

[6] Data on trial phase to be provided subsequent to implementation of digital infrastructure.

[7] Rolling average across the previous 12 months.

Indicators 2 and 3 are new measures which have only recently been reported due to the timescales within the measure itself. There is a lag between activity and data being recorded in the central system so data is expected to fluctuate month on month.

The Research Recovery, Resilience and Growth board is considering the specific activity needed to decrease study setup time and the areas identified such as shortages in certain areas of the workforce have been given a specific focus. We also need to consider how we create the environment in NHS organisations to deliver faster and predictable setup times.

Annex 2: recruitment figures for England, by study type and by region

Summary of recruitment in England by study type

Data source: NIHR Clinical Research Network (CRN) CPMS. Data refreshed 22 March 2024.

Recruitment in England. Recruitment is still being received and should not be regarded as complete.

Produced by NIHR CRN Business Intelligence team inforequest@nihr.ac.uk. The graphs represent the last 12 twelve months.

Summary of trust recruitment by NHS region

Data source: NIHR Clinical Research Network (CRN) CPMS. Data refreshed 22 March 2024.

Recruitment in England at currently open trusts (acute, care, ambulance, mental health).

Recruitment is still being received and should not be regarded as complete.

Produced by NIHR CRN Business Intelligence team inforequest@nihr.ac.uk. The graphs represent the last 12 twelve months.

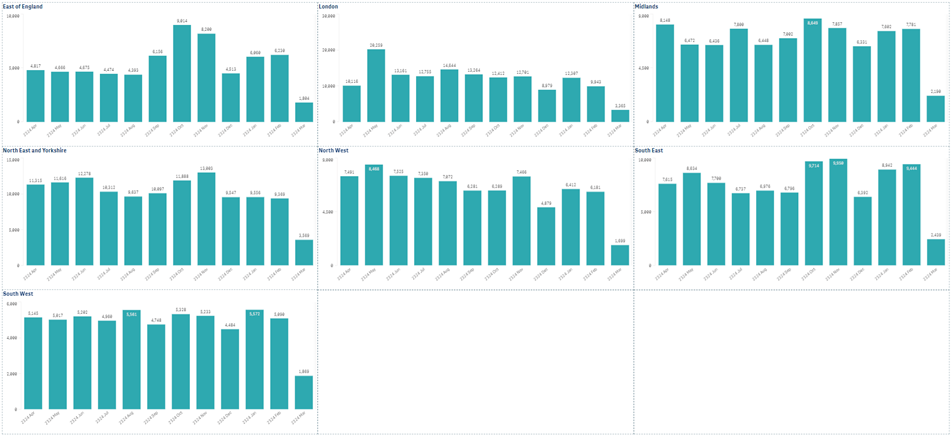

Summary of primary care recruitment by NHS region

Data source: NIHR Clinical Research Network (CRN) CPMS. Data refreshed 22 March 2024.

Recruitment in England at GP practices and GP surgeries.

Recruitment is still being received and should not be regarded as complete.

Produced by NIHR CRN Business Intelligence team inforequest@nihr.ac.uk. The graphs represent the last 12 twelve months.

Publication reference: Public Board paper (BM/24/21(Pu))